In early November 2025, markets stumbled after an extraordinary tech rally. Global indexes slipped as investors questioned whether the artificial-intelligence (AI) boom had gone too far. Even the entire “Magnificent Seven” — Nvidia, Amazon, Apple, Microsoft, Tesla, Alphabet, and Meta — fell in a single session, with the Nasdaq down about 2 percent and the S&P 500 off 1 percent amid worries over “elevated valuations.”¹ Palantir plunged nearly 8 percent despite a strong earnings report, and Nvidia gave back a chunk of its gains.² Warnings from JPMorgan’s Jamie Dimon and others that markets were “priced for perfection” suddenly appeared prescient.³

For nearly two years, the AI trade had been relentless. Since the viral debut of ChatGPT in late 2022, investors poured into anything AI-linked. The result was a breathtaking concentration of market wealth — and growing vulnerability when sentiment shifted.

Tech Titans and the AI Gold Rush

The “Magnificent Seven” have defined the post-pandemic bull market. In 2023 alone, they rose 76 percent, versus 24 percent for the broader S&P 500.⁴ By year-end they represented roughly 28 percent of the index’s total capitalization.⁵ Nvidia’s chips became indispensable to AI data centers, while software firms such as Palantir saw their shares soar thousands of percent.⁶ Altogether, the S&P 500 surged about 75 percent from late 2022, largely on AI enthusiasm.⁶ Bulls argued that big spending today would yield massive productivity gains later, noting that eight of the ten largest U.S. companies are AI-driven, together worth nearly $23 trillion — about the size of U.S. GDP.⁷

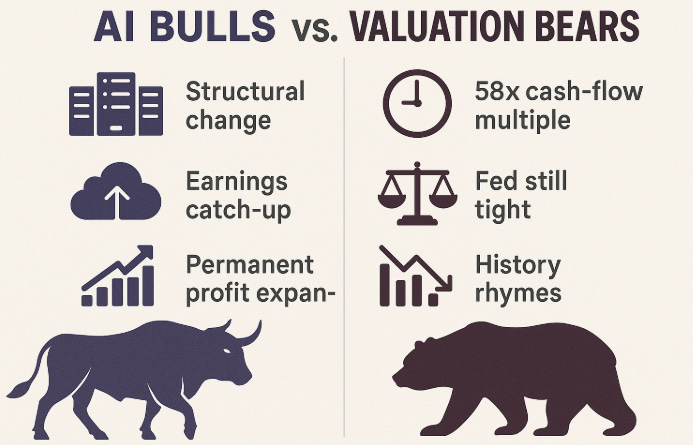

Yet the rally carried bubble-like hallmarks. The group’s combined market value topped $22 trillion before early-November’s drop erased $1 trillion in days.⁸ At their peak, these firms traded near 58 times free cash flow — about 77 times if adjusting for stock-based pay — levels rarely seen outside speculative manias.⁹ Their annual free cash flow was roughly $385 billion, well below the $568 billion in reported net income.¹⁰ By any historical standard, valuations were stretched.

Cracks in Tech’s Armor

When expectations run that high, even good news can disappoint. Investor Michael Burry, of “The Big Short” fame, took notice: filings showed Scion Asset Management devoted about two-thirds of its portfolio to put options on Palantir and another 14 percent on Nvidia — a $1 billion bet against the AI leaders.¹¹ Within days, markets shuddered. The Nasdaq slid 2 percent, the S&P 500 fell 1 percent, and the Magnificent Seven all declined.¹ Palantir dropped 7 percent, Nvidia 3.7 percent, and Amazon nearly 3 percent.² Even after Palantir raised its outlook, prices fell further — a sign that sentiment, not fundamentals, was driving trades.

The tremors spread abroad. Asian markets posted their sharpest losses in months as bank chiefs from Morgan Stanley and Goldman Sachs echoed JPMorgan’s warnings of a possible correction.³ Reuters reported that fears over “elevated valuations” in AI and tech had triggered the wobble.² It had been nine months since U.S. markets saw anything similar, and the speed of the $1 trillion sell-off reminded investors how quickly momentum can reverse.

Strategists split on the meaning. Some called it a “speed bump, not a wall,”² arguing that profit-taking after a blistering rally was normal. Others warned that multiples above 50× free cash flow left little margin for error — when valuations soar that high, “time itself becomes the biggest risk.”¹²

The Valuation Overhang

Fundamentals ultimately determine returns, and many signals suggest prices have outpaced earnings power. The Cyclically Adjusted Price/Earnings (CAPE) ratio for the S&P 500 now sits near 39.5, matching late-1990s bubble highs.¹³ Since 1957, the CAPE has exceeded 39 for just 22 months in total — all during the dot-com era.¹³ Following such extremes, the index’s average three-year return has been around –30 percent.¹⁴ While history isn’t destiny, it offers a clear caution.