Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

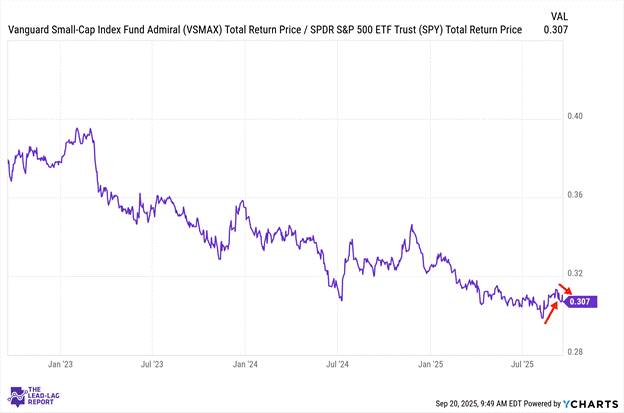

LEADERS: DO SMALL CAPS FINALLY HAVE THEIR CATALYST?

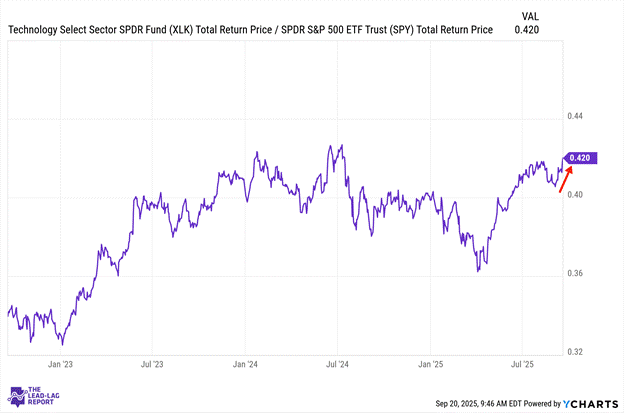

Technology (XLK) – AI Drives Revenue Growth

The technology sector continues to demonstrate resilience despite ongoing regulatory pressures. Recent earnings from major tech companies exceeded expectations with cloud computing and AI-related services driving revenue growth. The sector has been adapting to changing macroeconomic conditions, particularly the Federal Reserve’s interest rate policies, which have created both challenges and opportunities for tech valuations.

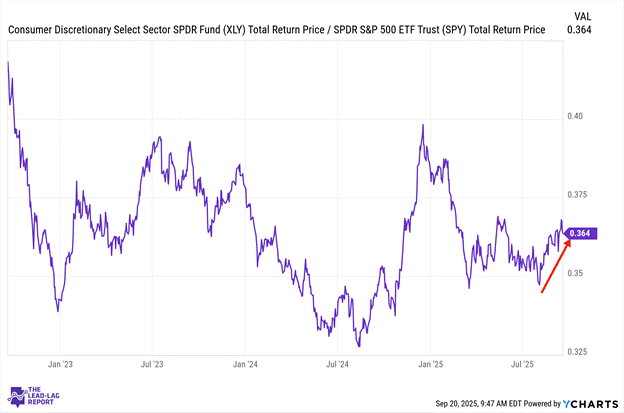

Consumer Discretionary (XLY) – Sensitive To Employment

Consumer discretionary has shown positive performance lately, largely influenced by economic data suggesting a resilient but cautious consumer. Luxury goods companies have reported stronger-than-expected sales, while mid-market retailers continue to face margin pressures. The sector remains sensitive to employment data and consumer confidence metrics, both of which have shown signs of stabilization in recent weeks.

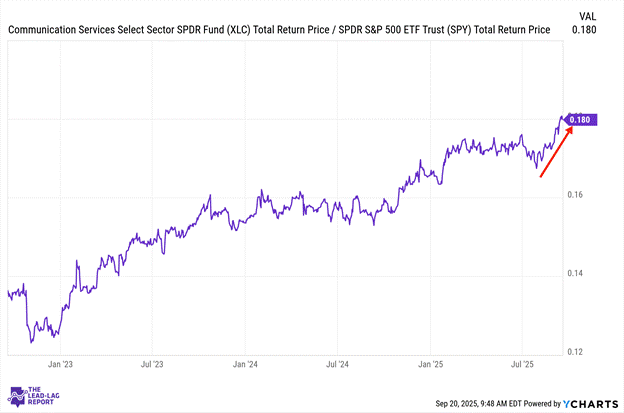

Communication Services (XLC) – Digital Advertising Is The Driver

Digital advertising revenue has rebounded significantly, benefiting major players in this sector. Streaming services continue to see subscription growth, albeit at a slower pace than during peak pandemic periods. Regulatory developments regarding content moderation and data privacy remain key watch points for investors in this space.

Small-Caps (VSMAX) – Regional Banks Remain A Pressure Point

Small caps have shown signs of relative value compared to their large-cap counterparts, though liquidity concerns persist. Recent economic data suggesting resilience in the domestic economy has provided support, as small-caps tend to have greater exposure to the U.S. economic swings. Banking concerns have disproportionately affected this segment due to higher reliance on regional banking relationships.

Long Bonds (VLGSX) – The Fed Provides A Jolt

Long-duration bonds have experienced volatility as investors reassess long-term inflation expectations and terminal rate projections. Duration risk remains a key consideration for fixed-income allocations with institutional investors carefully managing their exposure. Last week’s Fed rate cut briefly pushed this ratio to a multi-month high.

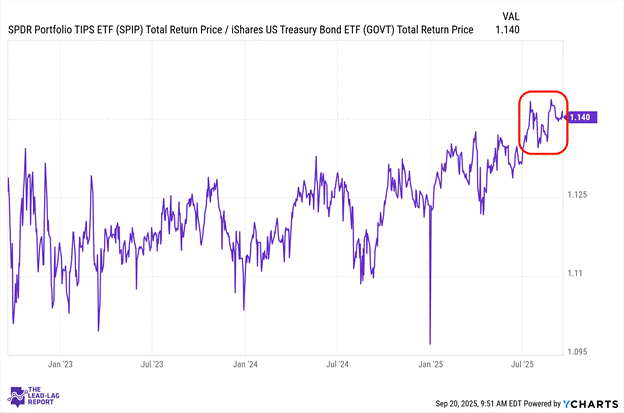

Treasury Inflation Protected Securities (SPIP) – Real Yields Stabilizing

Inflation-protected securities have adjusted to evolving inflation expectations. Break-even rates suggest market participants anticipate inflation moderating toward the Federal Reserve’s target range. Real yields have stabilized, providing more attractive entry points compared to recent years.

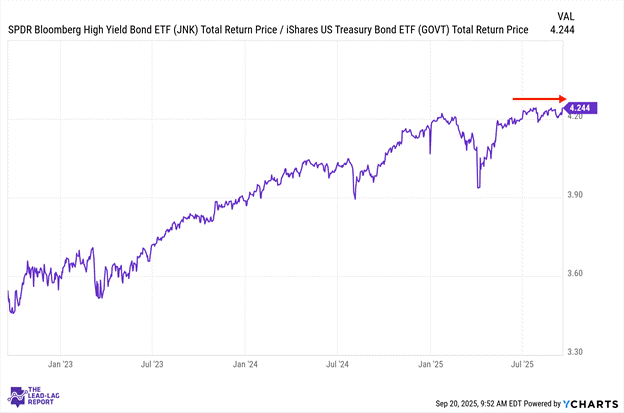

Junk Debt (JNK) – Credit Spreads Still Very Tight

High yield bonds have shown resilience despite recession concerns with default rates remaining below historical averages. Credit spreads have tightened in response to better-than-expected corporate earnings and balance sheet management. Sector dispersion within high-yield has increased, highlighting the importance of credit selection.

Emerging Markets (EEM) – Value Story Starting To Play Out