Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: GROWTH AND TECH KEEP CONTROLLING THE MARKET NARRATIVE

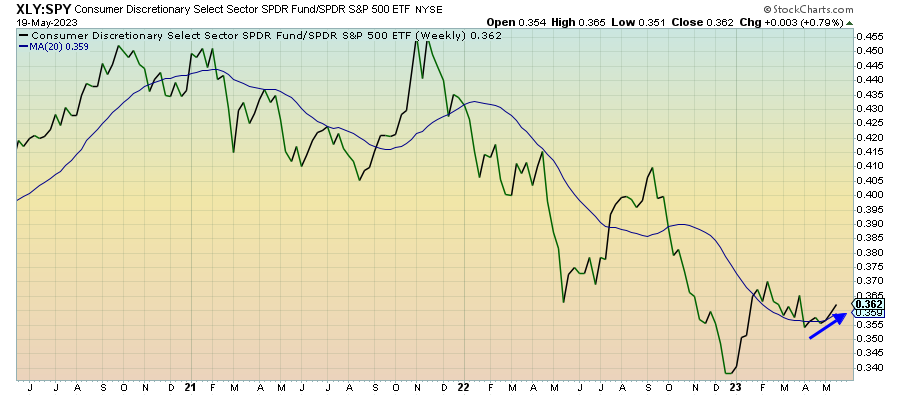

Consumer Discretionary (XLY) – Don’t Lose Sight Of The Big Picture

Consumer discretionary stocks continue to outperform as growth becomes in vogue again. We’re still getting warnings from the big retailers that conditions in general and consumer spending are getting weaker. Home Depot’s disappointing results were particularly interesting because they specifically cited lumber prices as a cause of poor earnings. Risk assets seem to be back in favor at the moment, but don’t lose sight of the big picture.

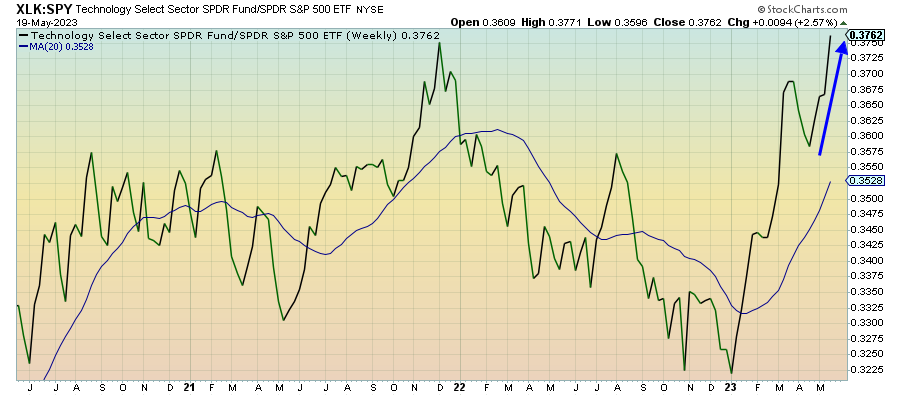

Technology (XLK) – Relative Value Looking Worse

Even though breadth within the sector has been poor and a handful of mega-caps are driving gains here, tech has undoubtedly done well in recent weeks. This ratio just cleared a new all-time high, which brings the question of relative value back into the discussion. Tech is back to trading at 26 times forward earnings, which usually isn’t where you want to be heading into an economic slowdown. It’s a big part of the reason this sector performed so poorly in 2022 and could be again soon.

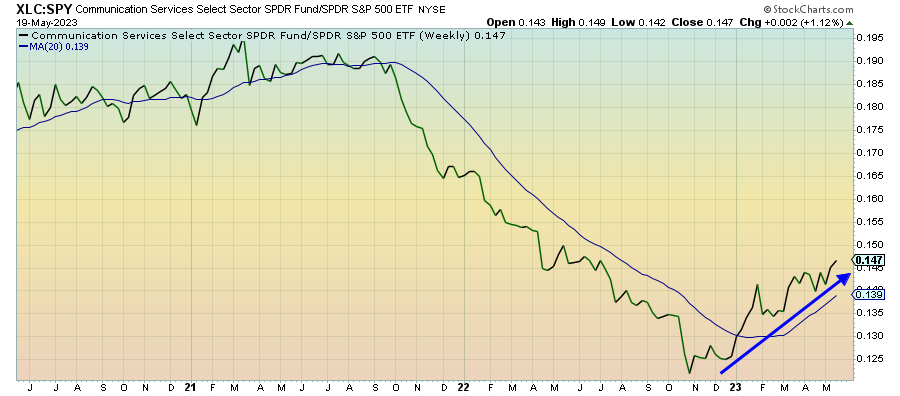

Communication Services (XLC) – Services Sector Driving Gains

Even though the manufacturing sector is growing worse by the month, the services sector remains a relative bright spot. That’s helped communication services capture and maintain leadership throughout the past six months. The ad spending conundrum, which had plagued Facebook and Alphabet, appears to have been corrected. Those two names will always drive this sector, but the rest of the group hasn’t been nearly so strong.

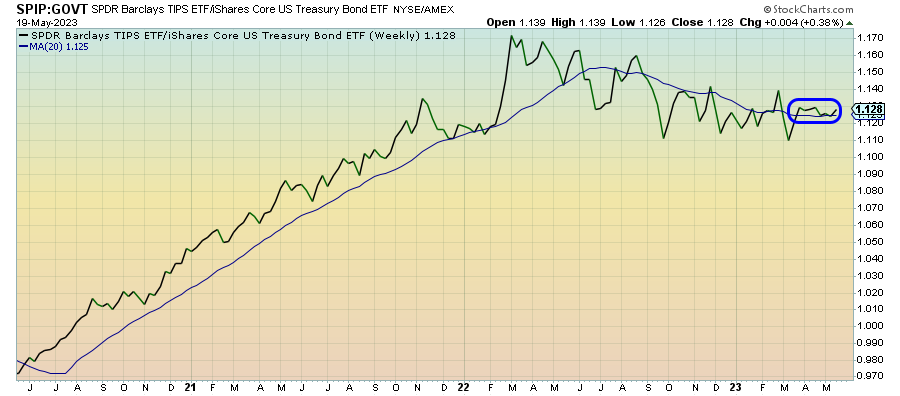

Treasury Inflation Protected Securities (SPIP) – Getting The Right Read

Inflation protection seems to be in wait-and-see mode, which is probably the right position for now. Annualized inflation will probably continue to come down over the next couple of months, but the persistent nature of core inflation means we very likely won’t see a return towards the Fed’s 2% target at least until 2024. It’s difficult to see TIPS interest decreasing significantly here.