The U.S. stock market continues to grind higher despite a range of potential headwinds. Investors have largely shrugged off soft economic data, geopolitical tension, and policy uncertainty. While low volatility suggests stability, volatility down often means complacency up. When markets are this quiet, investors may be letting their guard down—setting the stage for an abrupt shock.

Rallying Markets, Shrinking Fear

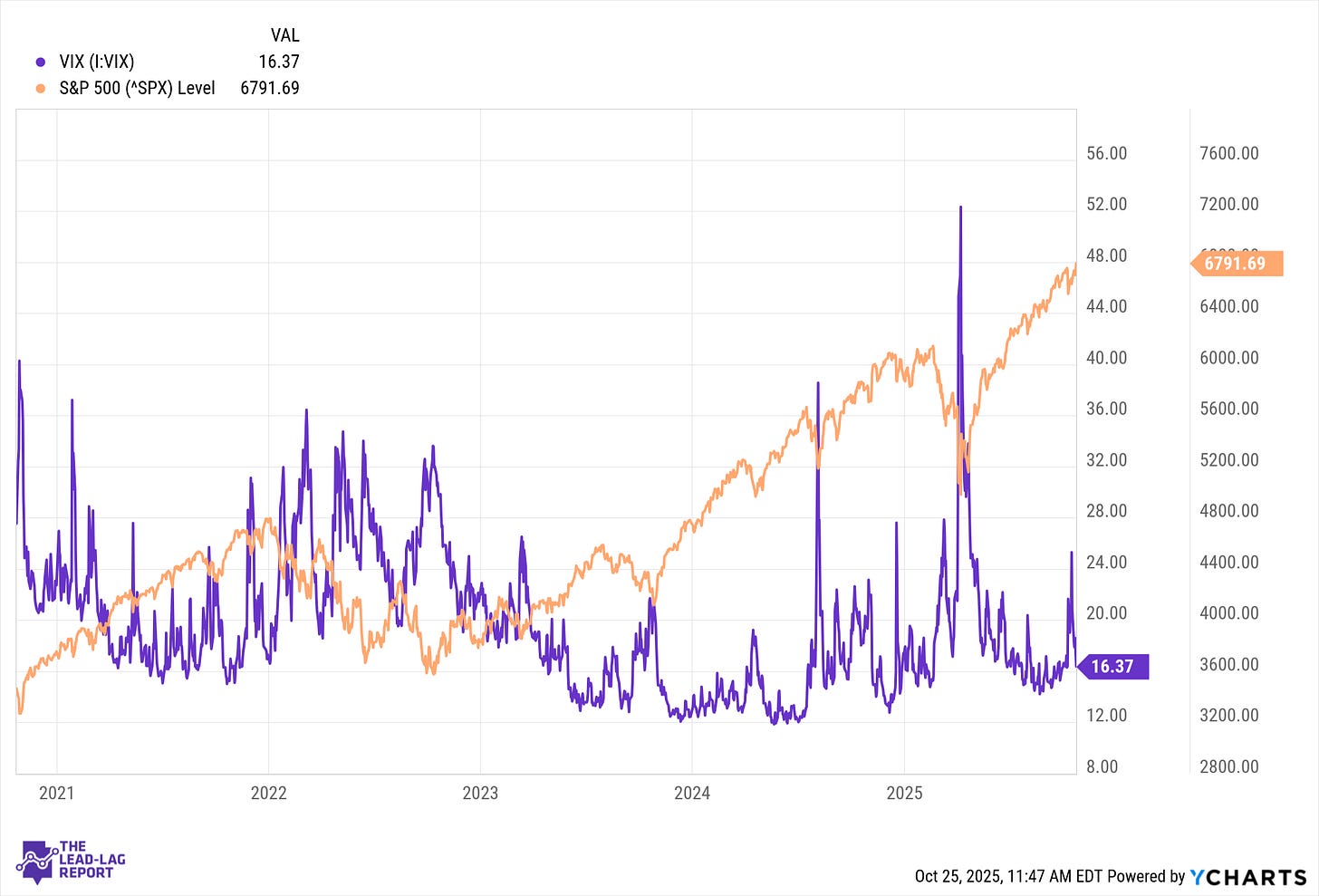

Markets are said to “climb a wall of worry,” and recent trends fit that adage. Despite higher rates, sticky inflation, and periodic global flare-ups, equities have risen steadily. Bond and currency volatility also fell to multi-year lows by mid-2025². Stock market volatility has followed, with realized equity volatility touching its lowest levels since mid-2024².

This broad-based calm shows how unfazed investors have become by risks that once rattled markets. Through summer 2025, Wall Street looked past weak data and geopolitical rumblings to maintain a “serene” rally¹. Yet history warns that tranquility often precedes turbulence. In 2023, the S&P 500 went over three months without even a 3% pullback—one of the longest streaks since World War II³. Similarly, in late 2017, the VIX spent weeks in the single digits, right before volatility spiked in early 2018.

Volatility Lows as Warning Signs

The VIX, often dubbed the market’s “fear gauge,” reflects investor demand for protection. A high VIX signals anxiety, while a low reading implies calm or complacency⁴. The old saying “When VIX is high, it’s time to buy; when VIX is low, it’s time to go” captures this pattern⁵. Empirically, when the VIX dips below about 20, sell-offs often follow—suggesting excessive optimism⁶.

Today’s mid-teens VIX raises the question: are investors underestimating risk? Volatility tends to be mean-reverting; calm rarely lasts forever. Long stretches of stability often invite risk-taking as investors extrapolate calm into the future⁷. When volatility returns, it tends to spike sharply, catching markets off guard. When volatility is low, investors often take on more risk and reduce hedges under the assumption calm will persist—but when volatility returns, it does so abruptly.⁸

Low volatility, in short, can plant the seeds for its own reversal.

Complacency Fuels Risk-Taking

A quiet market encourages riskier behavior. If every dip is bought and price swings are mild, why pay for hedges or hold cash?

Lower volatility often leads traders to increase leverage and speculative exposure. This creates the conditions for sudden accidents². Demand for hedging has fallen alongside option prices, as few feel urgency to buy protection.

The result is fragile market structure. Call-option buying hit record highs in late 2025¹⁰, suggesting many traders are betting on more upside rather than insuring against losses. Such one-sided optimism can turn even a modest pullback into a rout. Leverage amplifies every move, and when prices fall, margin calls trigger forced selling. Without hedges in place, the decline accelerates.

Black Swans and Fragile Calm

If this is the calm before the storm, what could spark the next one? While true “black swans” are unpredictable, several plausible catalysts stand out: