Walmart vs. Target: One Looks Good; One Looks Awful

Which Is Telling The Real Story?

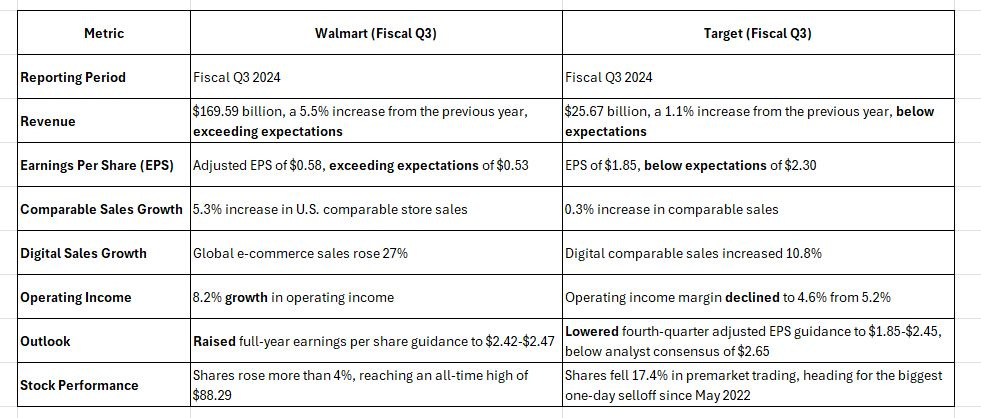

It was a big week for retail earnings as two of the industry’s heavyweights - Walmart and Target - reported 3rd quarter results.

Both companies have issued previous warnings about waning consumer sentiment. Target has gone in a little harder on that messaging this year and now we can understand why. Over the past quarter, Target’s results were a cornucopia of misery. Revenue growth missed estimates. Net income missed badly. Same store sales growth was virtually flat. Margins shrunk. Forward guidance was lowered. It was hard to find almost any good news in these results.

Walmart, on the other hand, delivered the opposite. Revenue & earnings beat expectations. Comparable store growth was solid. Forward guidance was raised. For being told often that we’re in a challenging retail environment, Walmart seems to be hitting on all cylinders.

As you can imagine, the market reacted pretty decisively to both, but especially so in the case of Target.