After the November 17 sell-off, the Weekly Signals framework is sending an early warning that the market’s risk environment may be shifting. The clearest sign comes from the Utilities vs. S&P 500 relative strength ratio. Although still officially in “Risk-On,” utilities’ defensive behavior during the decline puts the signal on the edge of turning. Such a flip would challenge the typical late-November seasonal tailwinds that usually support equities. In a year that has repeatedly broken from historical patterns, this potential shift deserves attention.

The Utilities vs. S&P 500 Signal Nears a Turn

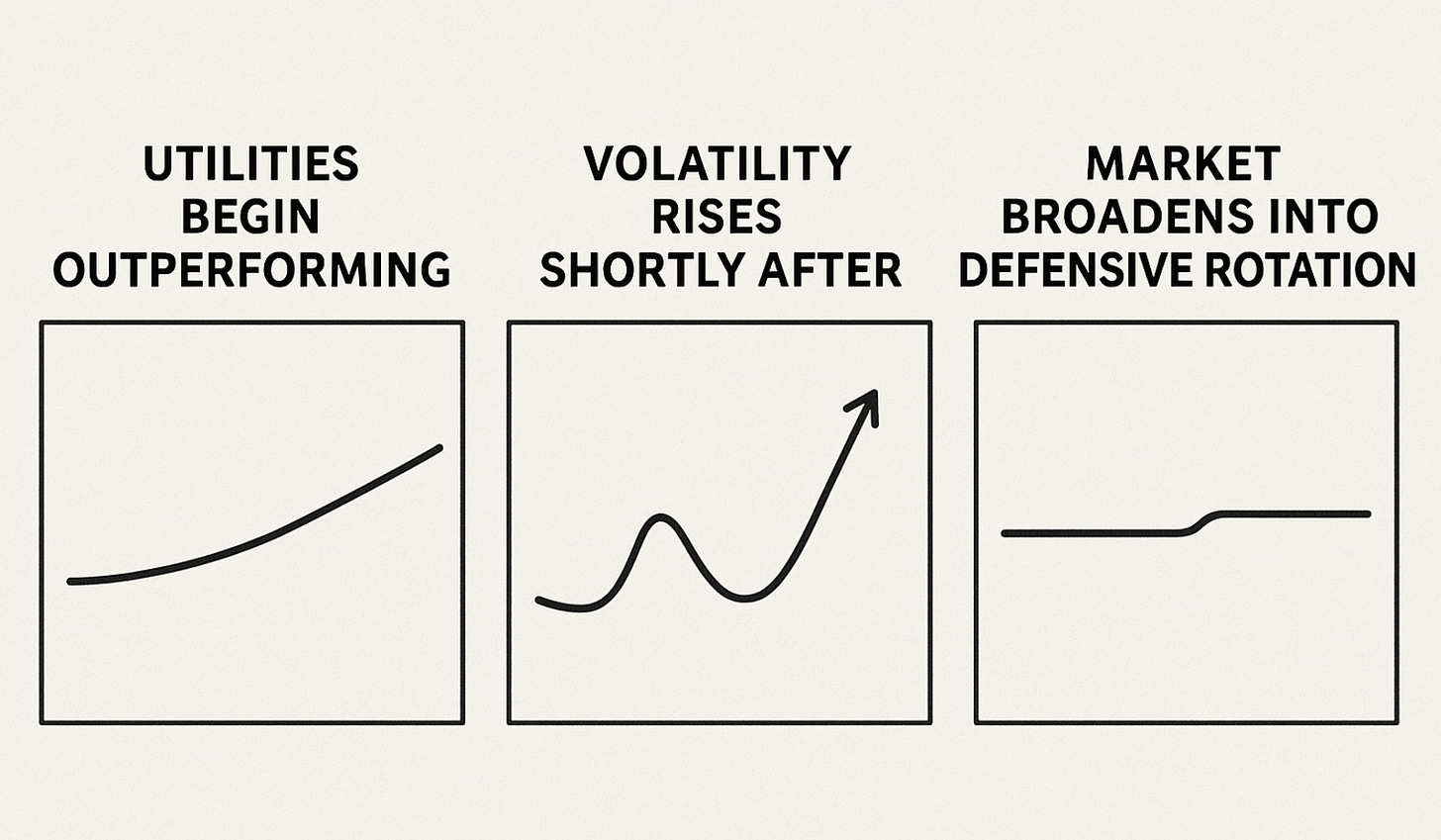

Utilities’ relative strength remains among the most reliable early indicators of changing market regimes. When investors grow uneasy, they tend to move toward essential services like electricity and water. When confidence is strong, cyclicals and growth stocks have the advantage. Because of this dynamic, utilities often outperform ahead of volatility spikes or equity pullbacks.

As of mid-November, the model still shows “Risk-On,” but the quiet resilience in utilities points to rising defensiveness under the surface. That kind of behavior often precedes a formal risk-off signal. A similar pattern occurred in 2019, when utilities strengthened steadily before a burst of tariff-driven volatility. The setup today looks similar, suggesting the risk-on stance may not last much longer. A confirmed flip would push recommended positioning toward safety—namely utilities, Treasuries, or low-volatility equity segments.

The takeaway is simple: when utilities start leading, the market is often sending a message. It’s not contrarian, quirky, or a random rotation. It’s a shift in tone. And when that tone turns, managing volatility becomes more important than chasing upside.

Today’s Market Action Echoes Prior Defensive Episodes

The November 17 decline carries many hallmarks of a risk-off day. High-beta sectors fell hardest, while defensive groups held steady. Treasuries rallied, gold firmed, and volatility climbed. These are not characteristics of a market in a stable risk-on environment.

The pattern recalls the sell-off on October 10, when the S&P 500 logged its steepest one-day drop in months and the Nasdaq tumbled. Utilities, however, barely moved. Their stability during that earlier episode—like today—was not coincidental. It reflected money rotating intentionally toward safety.

If this leadership pattern continues, the Weekly Signals model is increasingly likely to flip to risk-off. Historically, such flips precede periods of higher volatility. Market internals often shift before the headline indices react, and ignoring them can leave investors unprepared.

Seasonality Collides With 2025’s Reality

A risk-off turn in late November stands out because this period normally provides strong seasonal support. November and December have historically delivered some of the best monthly returns, contributing to the well-known “Santa Claus rally.” Markets often benefit from holiday optimism, year-end positioning, and improved sentiment.

But 2025 has not followed any seasonal script. The year has seen rallies during typically weak periods and weakness during times that normally carry strong seasonal winds. Investors who relied on seasonality alone have been repeatedly wrong-footed.

Seasonality is probability, not guarantee. Even historically strong months can experience turbulence when broader forces are at work. The failed 2018 holiday rally remains a clear reminder that seasonal patterns can collapse quickly when markets become stressed.

With uneven inflation dynamics, tightening financial conditions, and geopolitical risks shaping the year, historical patterns have had little influence. As complacency builds around expectations of a holiday rally, the quiet rise in defensive signals demands greater respect.

Risks Building Beneath the Market Surface

The shift toward defensiveness is not happening in isolation. Several structural pressures have been building over the past few weeks: