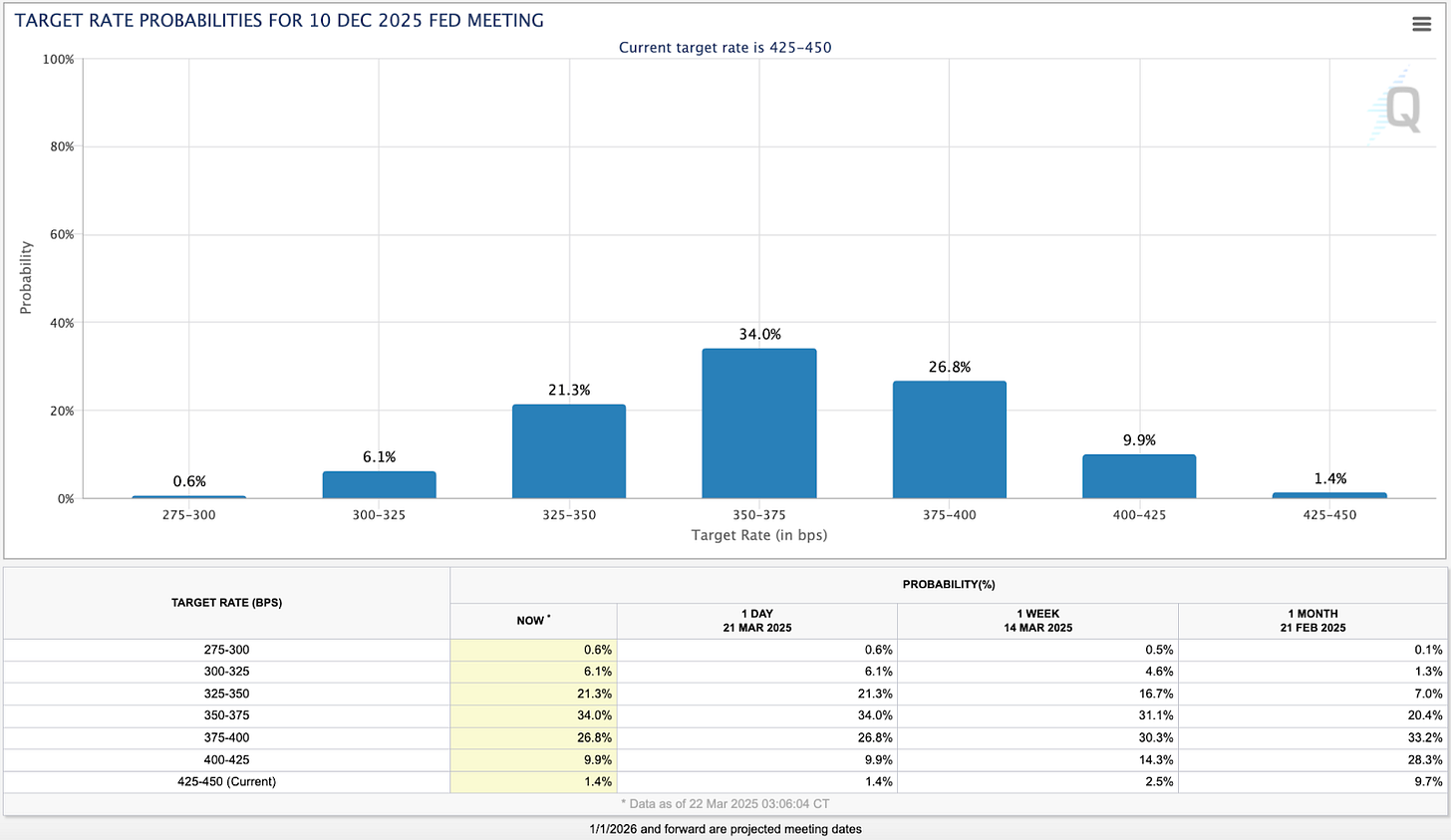

As it stands right now, the Fed Funds futures market is pricing in roughly three rate cuts by the end of the year, starting with the first cut in June. That’s a more dovish stance than we saw just a month ago when the market was leaning towards just 1-2 cuts.

On the surface, Powell has told the market that the Fed is in no rush to lower interest rates, preferring to take a wait-and-see approach to better understand whether tariff-related inflation or slowing global growth is the bigger risk to the U.S. economy right now.

But Powell also said during the Fed’s March meeting that it will be slowing down balance sheet runoff from $25 billion a month to just $5 billion a month starting in April. This signals to me that, even though Powell says outwardly that rate cuts aren’t imminent, he’s already moving to add liquidity to the system. He’s effectively saying that he’s looking to position a slowing economy as Fed target #1. Inflation may be a risk, but it’s getting pushed down the priority scale.

The “hold rates and add liquidity” approach could effectively give Powell justification that he’s tackling inflation and growth at the same time. The Fed raised its forward-looking inflation expectations while lowering its growth forecast, so that would be consistent with the messaging. With the current inflation rate already at 2.8% and the core rate still north of 3%, those aren’t really the conditions where making three rate cuts makes sense.

But if the Fed is going to target slowing growth by reducing QT (and maybe even eventually flipping to QE), while using rates to target inflation, is it reasonable to think that we may get no action at all on rates?

No Rate Cuts In 2025

Inflation remains above trend and, even though the headline rate ticked lower in February, that was expected. My baseline expectation based on the past year is that inflation could slowly trend lower in the spring before re-accelerating this summer. The 6-month annualized rate of inflation is about 3.5% and that’s even before the impact of tariffs.

Unless the economy suddenly falls off a cliff in the next quarter or two, which isn’t impossible, the Fed’s unlikely to have a real case for lowering rates.

The wild card is how much pain the White House is willing to inflict on the economy in order to reset conditions for the next leg.