What Is Happening In The Treasury Market?

It Could Be Inflation, Liquidity, Trump Or Manipulation

This week, as investors focus on surging U.S. equity prices following the election, I’m focused on a situation that I think is far more serious. And confusing. That is the bond market.

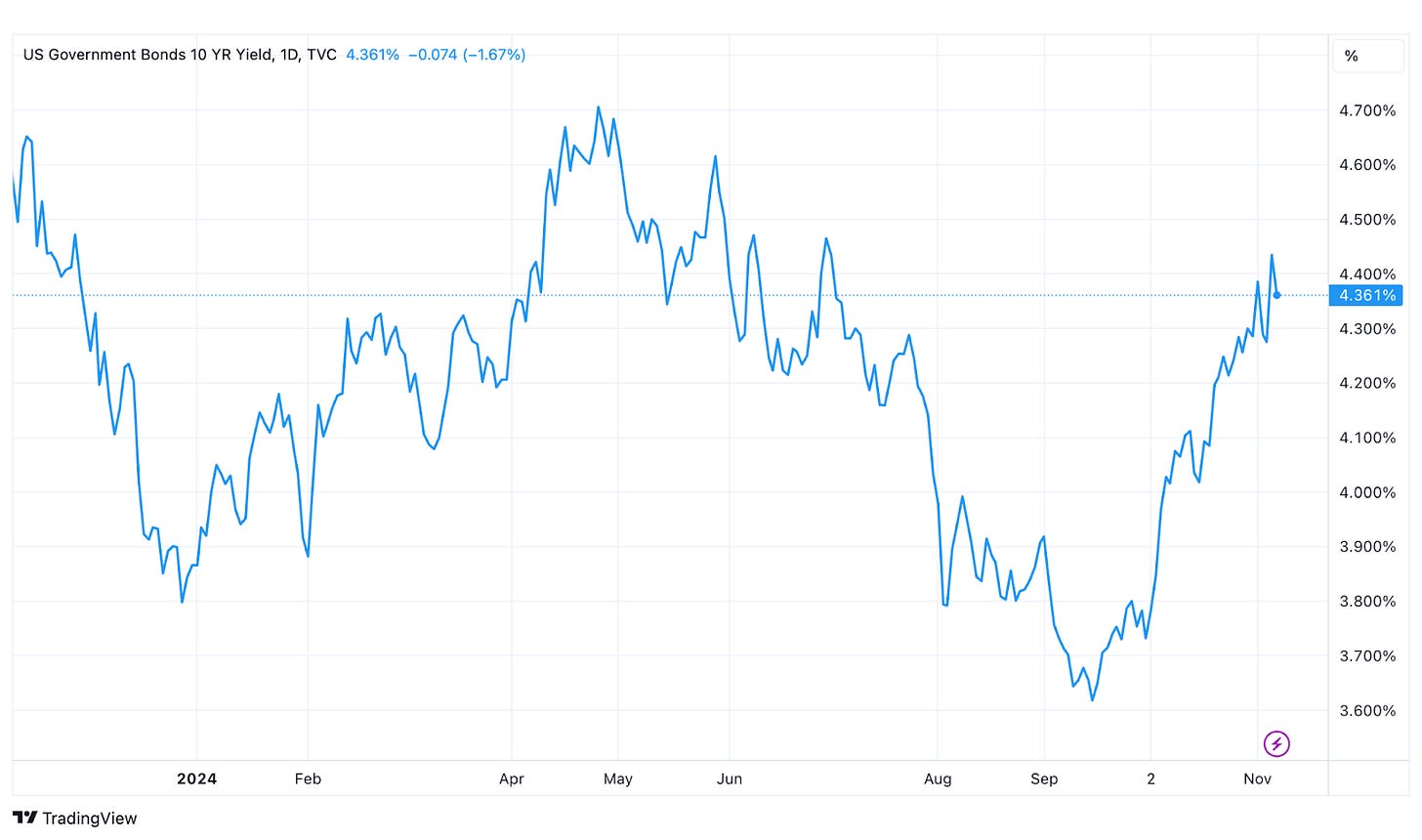

Since the middle of September, the yield on the 10-year Treasury has risen by more than 80 basis points from valley to peak.

It’s now back to the levels we saw in spring when the markets were weighing a Fed that was continuing to pursue a restrictive policy path and had begun floating concerns about how long sticky inflation might be a problem.

This past summer, Powell finally said that inflation was in a satisfactory spot and the Fed was in a position to begin easing. Yields began falling, as expected, and the whole yield curve shifted lower.

Then things changed. We kept getting data that was supportive of the resilient economy theme, but the Fed’s forecast called for roughly 150 basis points of further cuts by the end of 2025. That alone should have helped serve to keep pulling the yield curve lower, but instead yields started to move higher. And just by a little. By a LOT!

Over the past two months, this has easily been, in my opinion, the biggest WTF happening in the markets today.

The big question, of course, is why. No one really has a clear definitive answer, but there are lots of theories. I have a few of my own and I think it’s important to figure this out quickly. When something inexplicable like this happens, it usually means something is at risk of breaking.

So let’s run down the potential culprits (and if you’ll bear with me, I’ll get a little conspiratorial too).

Fed Policy Mistake / Inflation Risk

Treasury yields generally lead the Fed Funds rate (insert your own “the Fed is always behind the curve” joke here). Over the past three years, this has been the case. By the time the Fed made its first rate cut in 2022 (which was widely viewed as too late even as it was happening), the 10-year yield had risen by 100 points from where it was just a few months earlier.