What Tilray’s Addition to FMKT Says About the ETF’s Regulatory-Driven Strategy

Key Highlights

FMKT’s addition of Tilray underscores its focus on identifying companies positioned to benefit from regulatory change, rather than relying on traditional sector-based classification.

Federal cannabis rescheduling marked a meaningful shift in U.S. drug policy, creating a potential inflection point that aligns directly with FMKT’s deregulation-driven mandate.

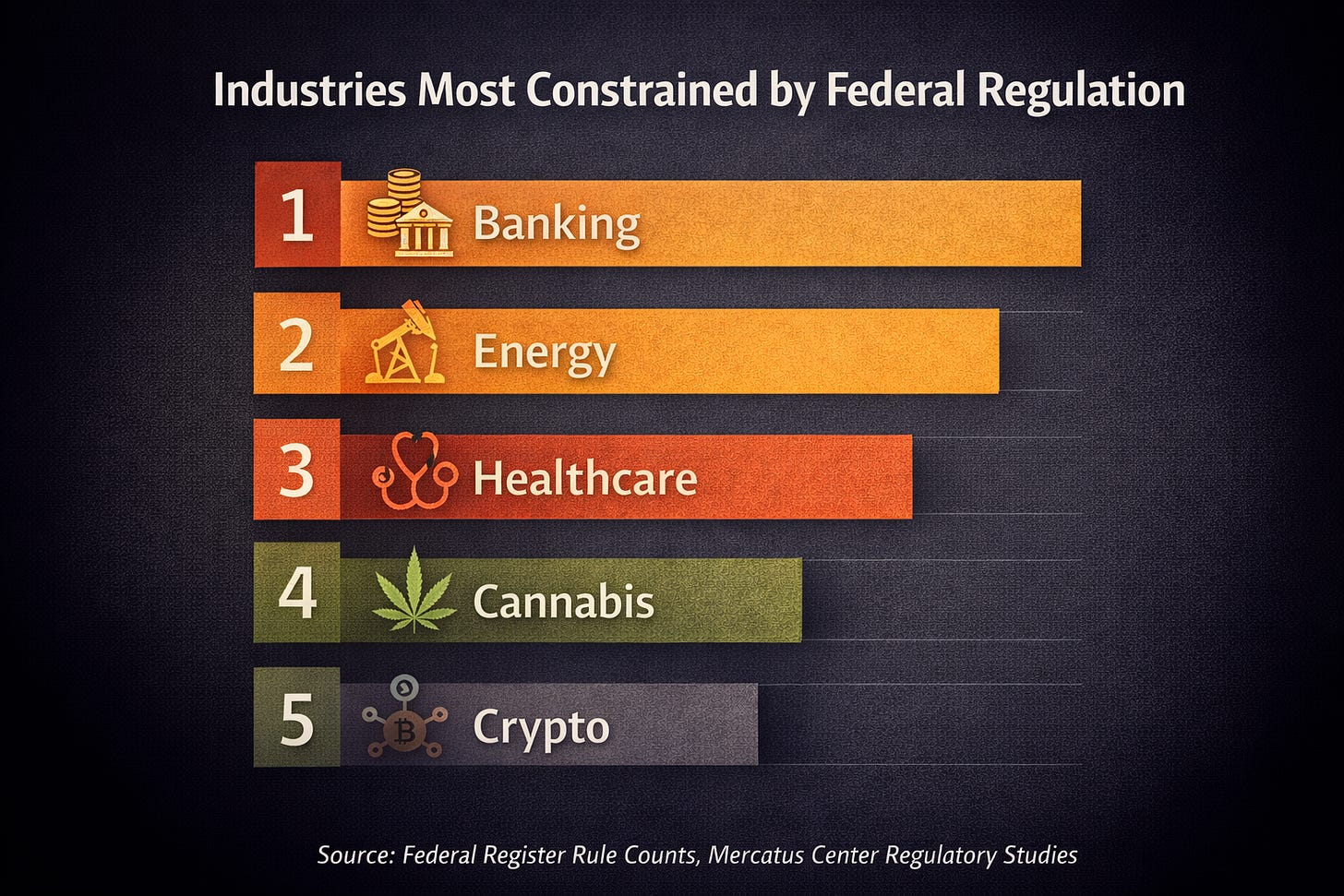

By including cannabis alongside energy, financials, healthcare, and digital assets, FMKT applies a cross-sector approach to deregulation, treating policy shifts as market catalysts.

Tilray’s inclusion demonstrates how FMKT translates real-time regulatory developments into portfolio decisions, prioritizing policy sensitivity over short-term price momentum.

FMKT’s strategy highlights the growing investment relevance of government action, particularly when long-standing regulatory barriers begin to ease.

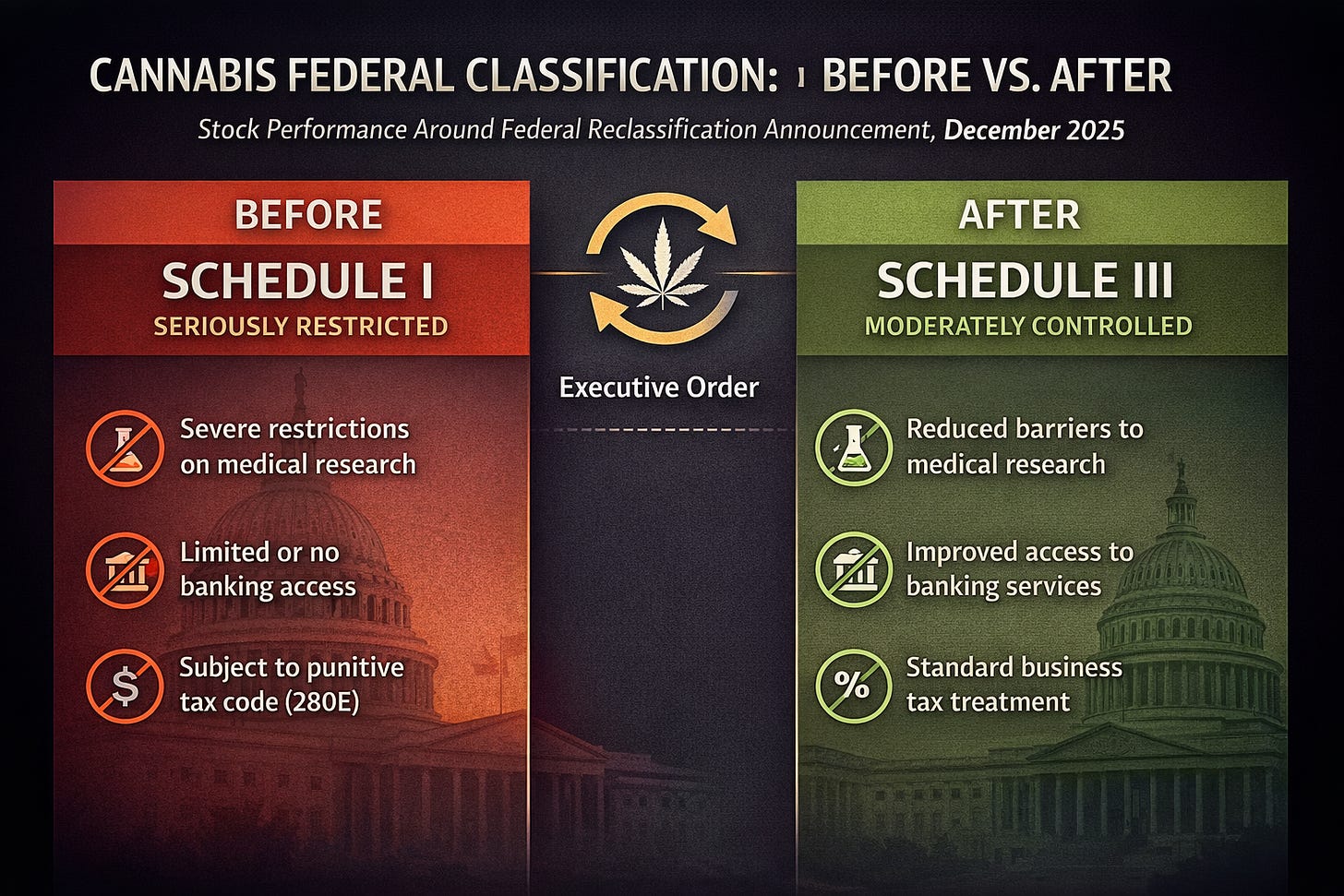

A Regulatory Shock That Reignited Cannabis Stocks

When cannabis stocks suddenly surge on whispers out of Washington, investors tend to pay attention. Late last year, shares of Tilray Brands jumped sharply in a single session after reports suggested the White House was preparing to ease federal marijuana restrictions.¹ The speculation quickly proved well-founded. In mid-December, President Donald Trump signed an executive order directing regulators to reclassify cannabis under federal drug law, shifting it from the most restrictive category to a less punitive designation.² The move marked one of the most significant changes in U.S. cannabis policy in decades and reignited interest across the entire sector.

The market response was swift. Cannabis equities rallied broadly as investors reassessed the industry’s long-term prospects under a more permissive regulatory framework.³ Exchange-traded funds focused on marijuana companies posted their strongest sessions in years, underscoring just how sensitive the sector remains to policy developments.⁴ For many investors, the episode reinforced a familiar lesson: regulatory change can be a powerful market catalyst, particularly in industries that have long operated under heavy legal constraints.

For the Free Markets ETF, however, the moment represented more than a short-term trading opportunity. FMKT, an actively managed fund designed to invest in companies positioned to benefit from deregulation, responded by adding Tilray to its portfolio. That decision offers a useful window into how the fund approaches policy-driven opportunities and why cannabis now fits squarely within its broader investment thesis.

Why Cannabis Fits FMKT’s Deregulation Framework

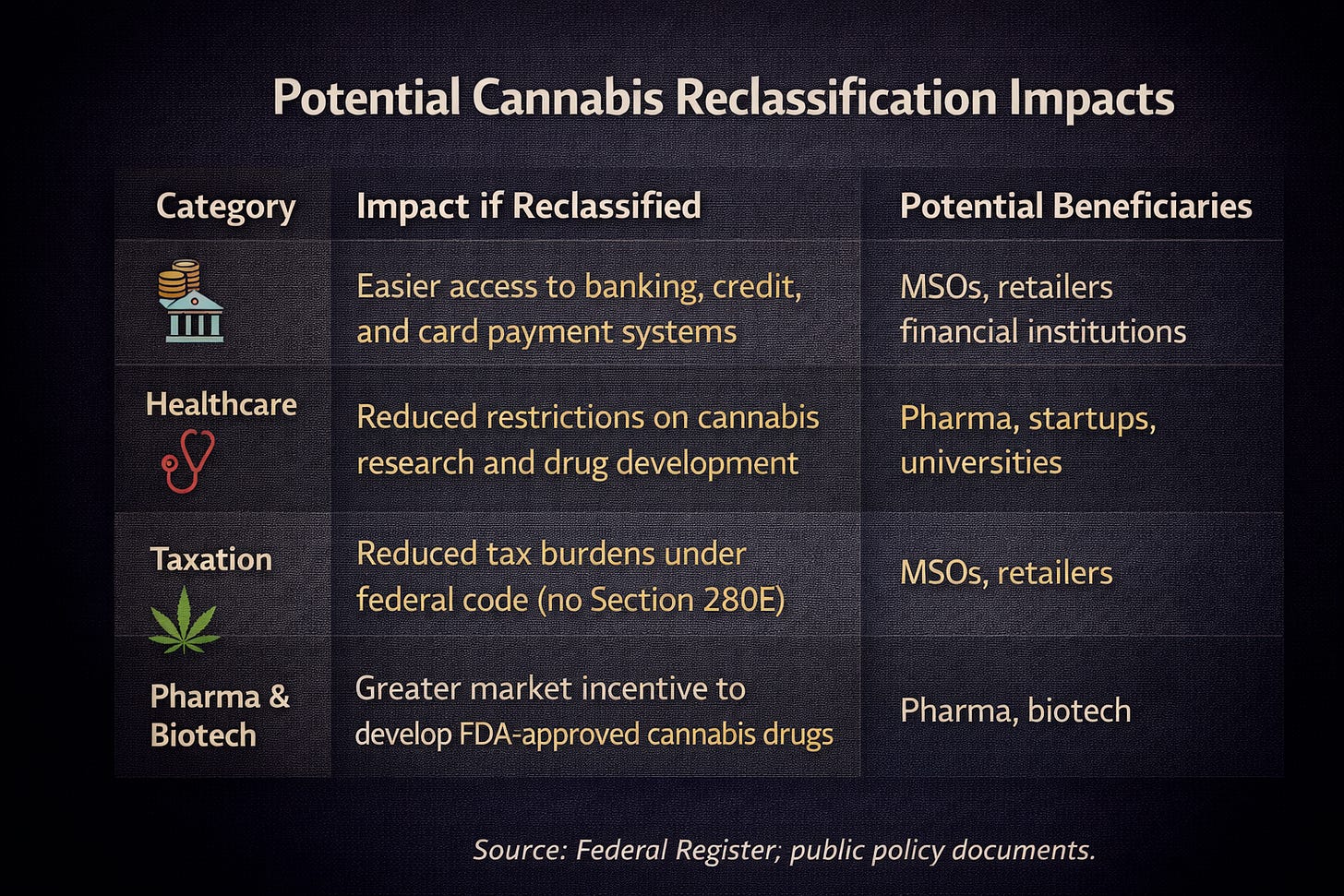

Trump’s executive order instructed federal agencies to expedite the process of reclassifying cannabis, acknowledging its accepted medical uses and lowering the regulatory barriers surrounding research and commercialization.² While the change stopped short of full federal legalization, it represented a meaningful departure from decades of prohibition. Importantly, reclassification has practical implications for cannabis operators. It could ease tax burdens created by existing federal rules and reduce obstacles to banking access, two long-standing challenges for the industry.⁵

These structural constraints have weighed heavily on cannabis companies for years, regardless of state-level legalization. As a result, even incremental federal reform has the potential to materially alter business fundamentals. Analysts quickly noted that a more accommodating regulatory stance could improve operating conditions and attract new pools of capital to the sector.⁶ That prospect helped fuel the rally in names like Tilray, Canopy Growth, and Cronos Group following the announcement.¹

The broader significance lay in what the order suggested politically. Federal cannabis reform has historically been uncertain and often stalled by partisan divisions. The decision to act through executive authority signaled that policy momentum may be shifting more decisively than many investors had expected. That perception alone was enough to reset expectations across the market.

The Free Markets ETF was launched with a clear organizing principle: identify companies that stand to benefit as regulatory burdens ease across the economy.⁷ Unlike sector-specific funds, FMKT is structured around policy dynamics rather than traditional industry classifications. Its portfolio spans financial services, energy, healthcare, and other areas where compliance costs and regulatory oversight materially influence profitability.⁸

Tilray’s inclusion reflects that framework in action. Cannabis remains one of the most heavily regulated industries in the United States, particularly at the federal level. Any credible move toward regulatory normalization has the potential to reshape competitive dynamics, cost structures, and growth opportunities. From FMKT’s perspective, cannabis reform represents the kind of inflection point the fund seeks to capture.

Translating Policy Change Into Portfolio Strategy

The fund’s managers have emphasized that deregulation can unlock value in ways conventional analysis often underestimates.⁷ By monitoring legal developments, executive actions, and policy signals, FMKT aims to position ahead of changes that may not yet be fully reflected in market pricing. In that context, Tilray’s addition was less a bet on near-term volatility and more an expression of confidence that the regulatory backdrop for cannabis is evolving in a more market-friendly direction.

FMKT’s portfolio construction underscores that cannabis is not a standalone theme but part of a broader strategy. The fund employs a combination of quantitative screening and fundamental judgment to identify companies with high sensitivity to regulatory costs.⁹ That approach has led to a diverse mix of holdings, including banks affected by financial regulation, energy companies influenced by environmental policy, and healthcare firms navigating drug approval and pricing frameworks.⁸

What unites these positions is the expectation that policy shifts can improve operating flexibility and economic returns. Cannabis reform fits naturally within that logic. The industry’s challenges have been rooted less in demand than in legal and financial constraints. Reducing those frictions could enable more efficient capital allocation, improved margins, and broader participation from institutional investors.

By adding Tilray, FMKT effectively acknowledged that cannabis is transitioning from a marginal, policy-constrained market toward a more normalized segment of the economy. The move aligns with the fund’s broader belief that deregulation, when it occurs, can act as a catalyst for meaningful change across industries.

Investing based on regulatory change inevitably involves uncertainty. Executive actions can face legal challenges, implementation delays, or political reversal. FMKT’s strategy openly acknowledges those risks, emphasizing that policy outcomes are rarely linear or guaranteed.⁷ Yet the potential upside remains clear. Easing regulatory barriers can remove long-standing inefficiencies and allow market forces to operate more freely, creating optionality that traditional index strategies often overlook.

Tilray’s entry into FMKT serves as a case study in how regulatory shifts can reshape investment narratives. It highlights the growing importance of policy awareness in portfolio construction and reinforces why deregulation remains central to FMKT’s strategy. For investors, the broader lesson is simple: when the rules of the game change, markets often respond, sometimes faster and more forcefully than expected.

Consider FMKT. I believe in it. I wouldn’t have launched the fund if I didn’t.

Footnotes

Business Insider, “Weed Stocks Are Surging on News Trump Could Ease Restrictions on the Drug,” December 12, 2025.

ABC News, “Trump Signs Executive Order Easing Marijuana Restrictions by Reclassifying Drug,” December 18, 2025.

Business Insider, “Cannabis Stocks Jump as Investors Anticipate Federal Policy Shift,” December 12, 2025.

Nasdaq, “Cannabis ETFs Soar Double-Digits on Reclassification Hopes,” December 13, 2025.

Nasdaq, “Why Cannabis Reclassification Could Ease Taxes and Banking Barriers,” December 13, 2025.

Nasdaq, “Analysts See Federal Reform as a Positive Catalyst for the Cannabis Industry,” December 13, 2025.

Business Wire, “Tidal Investments LLC Launches the Free Markets ETF (FMKT), First-of-Its-Kind Fund Targeting Companies Benefiting from Deregulation,” June 10, 2025.

Reuters, “U.S. Firms Launch ETF to Capitalize on Trump’s Deregulation Push,” June 10, 2025.

ETF.com, “New ETF Targets Companies Poised for Deregulation Relief,” June 11, 2025.

Past performance is no guarantee of future results.

The Fund’s investment objectives, risks, charges, expenses and other information are described in the statutory or summary prospectus, which must be read and considered carefully before investing. You may download the statutory or summary prospectus or obtain a hard copy by calling 855-994-4004 or visiting www.freemarketsetf.com. Please read the Prospectuses carefully before you invest.

Investing involves risk including the possible loss of principal.

FMKT is distributed by Foreside Fund Services, LLC.

Find full holding details and learn more about FMKT at

http://www.freemarketsetf.com.

Holdings are subject to change.

Deregulation Strategy Risks.The Fund’s strategy of investing in companies that may benefit from deregulatory measures entails significant risks, including those stemming from the unpredictable nature of regulatory trends. Deregulation is influenced by political, economic, and social factors, which can shift rapidly and in unforeseen directions. Changes in government priorities, political leadership, or public sentiment may result in the reversal of existing deregulatory policies or the introduction of new regulations that could adversely affect certain industries or companies. Further, while the Fund invests in companies expected to benefit from deregulatory initiatives, not all of these companies may achieve the expected advantages, whether fully, partially, or at all. The actual impact of deregulatory measures may vary widely depending on a company’s specific operational, financial, and competitive circumstances. Companies may also face challenges adapting to new regulatory environments, or their competitive positioning may be undermined by other market factors unrelated to deregulation. These risks could negatively affect the performance of the Fund’s portfolio.

Underlying Digital Assets ETP Risks. The Fund’s investment strategy, involving indirect exposure to Bitcoin, Ether, or any other Digital Assets through one or more Underlying ETPs, is subject to the risks associated with these Digital Assets and their markets. These risks include market volatility, regulatory changes, technological uncertainties, and potential financial losses. As with all investments, there is no assurance of profit, and investors should be cognizant of these specific risks associated with digital asset markets.

● Underlying Bitcoin and Ether ETP Risks: Investing in an Underlying ETP that focuses on Bitcoin, Ether, and/or other Digital Assets, either through direct holdings or indirectly via derivatives like futures contracts, carries significant risks. These include high market volatility influenced by technological advancements, regulatory changes, and broader economic factors. For derivatives, liquidity risks and counterparty risks are substantial. Managing futures contracts tied to either asset may affect an Underlying ETP’s performance. Each Underlying ETP, and consequently the Fund, depends on blockchain technologies that present unique technological and cybersecurity risks, along with custodial challenges in securely storing digital assets. The evolving regulatory landscape further complicates compliance and valuation efforts. Additionally, risks related to market concentration, network issues, and operational complexities in managing Digital Assets can lead to losses. For Ether specifically, risks associated with its transition to a proof-of-stake consensus mechanism, including network upgrades and validator centralization, may add additional uncertainties.

●Bitcoin and Ether Investment Risk: The Fund’s indirect investments in Bitcoin and Ether through holdings in one or more Underlying ETPs expose it to the unique risks of these digital assets. Bitcoin’s price is highly volatile, driven by fluctuating network adoption, acceptance levels, and usage trends. Ether faces similar volatility, compounded by its reliance on decentralized applications (dApps) and smart contract usage, which are subject to innovation cycles and adoption rates. Neither asset operates as legal tender or within central authority systems, exposing them to potential government restrictions. Regulatory actions in various jurisdictions could negatively impact their market values. Both Bitcoin and Ether are susceptible to fraud, theft, market manipulation, and security breaches at trading platforms. Large holders of these assets (”whales”) can influence their prices significantly. Forks in the blockchain networks—such as Ethereum’s earlier split into Ether Classic—can affect demand and performance. Both assets’ prices can be influenced by speculative trading, unrelated to fundamental utility or adoption.

● Digital Assets Risk: Digital Assets like Bitcoin and Ether, designed as mediums of exchange or for utility purposes, are an emerging asset class. Operating independently of any central authority or government backing, they face extreme price volatility and regulatory scrutiny. Trading platforms for Digital Assets remain largely unregulated and prone to fraud and operational failures compared to traditional exchanges. Platform shutdowns, whether due to fraud, technical issues, or security breaches, can significantly impact prices and market stability.

● Digital Asset Markets Risk: The Digital Asset market, particularly for Bitcoin and Ether, has experienced considerable volatility, leading to market disruptions and erosion of confidence among participants. Negative publicity surrounding these disruptions could adversely affect the Fund’s reputation and share trading prices. Ongoing market turbulence could significantly impact the Fund’s value.

● Blockchain Technology Risk: Blockchain technology underpins Bitcoin, Ether, and other digital assets, yet it remains a relatively new and largely untested innovation. Competing platforms, changes in adoption rates, and technological advancements in blockchain infrastructure can affect their functionality and relevance. For Ether, the dependence on its proof-of-stake mechanism and smart contract capabilities introduces risks tied to network performance and scalability. Investments in blockchain-dependent companies or vehicles may experience market volatility and lower trading volumes. Furthermore, regulatory changes, cybersecurity incidents, and intellectual property disputes could undermine the adoption and stability of blockchain technologies.

Recent Market Events Risk. U.S. and international markets have experienced and may continue to experience significant periods of volatility in recent years and months due to a number of economic, political and global macro factors including uncertainty regarding inflation and central banks’ interest rate changes, the possibility of a national or global recession, trade tensions and tariffs, political events, war and geopolitical conflict. These developments, as well as other events, could result in further market volatility and negatively affect financial asset prices, the liquidity of certain securities and the normal operations of securities exchanges and other markets, despite government efforts to address market disruptions.

New Fund Risk. The Fund is a recently organized management investment company with no operating history. As a result, prospective investors do not have a track record or history on which to base their investment decisions.

. Lead-Lag Publishing, LLC is not an affiliate of Tidal/Toroso, Tactical Rotation Management, LLC, SYKON Asset Management, Point Bridge Capital, or ACA/Foreside.