We’re now one week removed from the 2024 presidential election and the Trump trades are showing little sign of slowing down. Most notable, of course, is bitcoin, which has gone from around $67,000-$68,000 the day before the election to around $88,000 as I write this. All signs point to the new administration being much more crypto-friendly from Elon Musk’s likely constant presence around the White House and the expectation that Gary Gensler could soon be fired as SEC chair, someone who has been much less favorable towards crypto in the past.

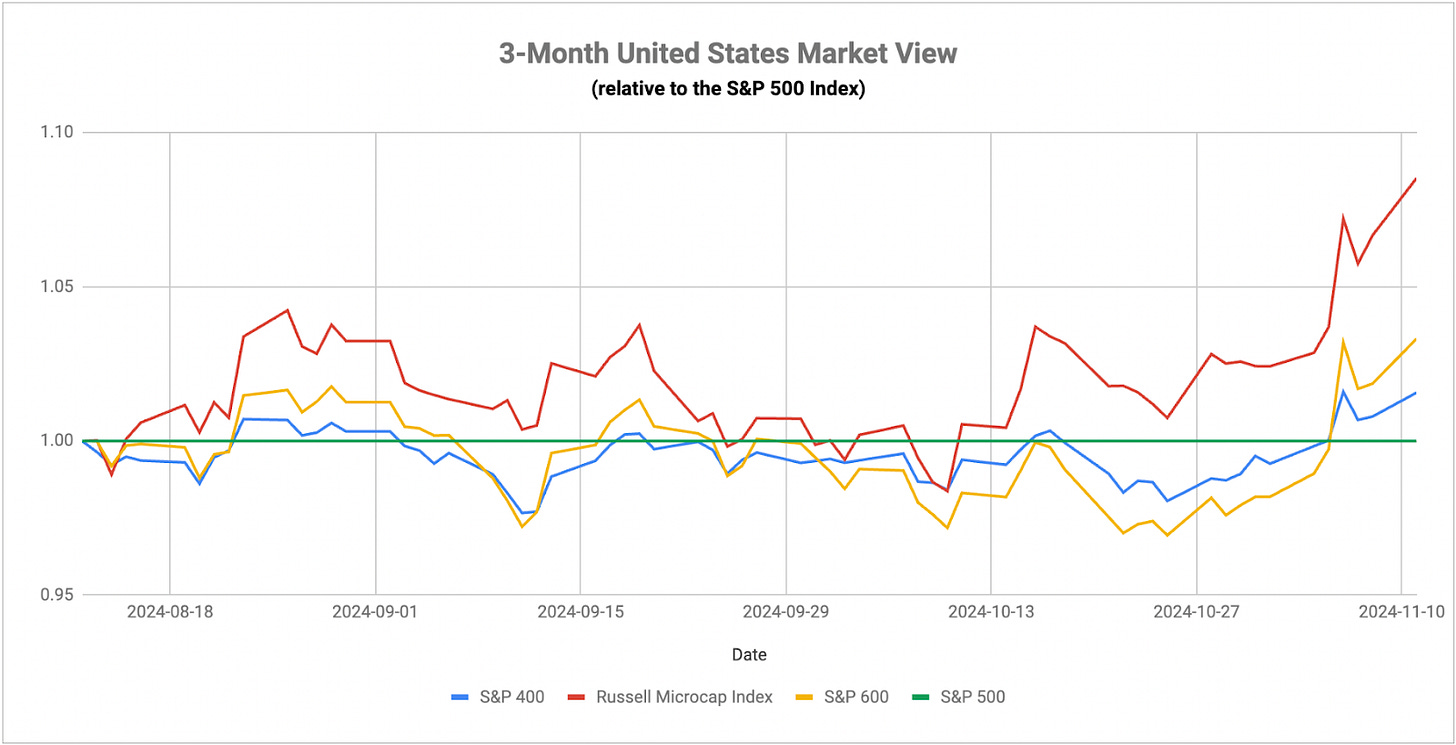

What’s interesting here is that if you look at the path of U.S. equity returns over the past week, there hasn’t been just a gentle drift towards small-caps over large-caps, it’s been an outright leap. That’s pretty evident looking at just the chart above, but it’s notable that the equal-weight S&P 500 has actually underperformed the traditional index even though small-caps have jumped into favor. I’ve been pounding the table for a while that small-caps not only could be one of the biggest beneficiaries of a Trump re-election, but may hold the key for the markets in general. The degree to which they’ve outperformed thus far and the strength of the move suggests that this rally could have some long-term legs. I’d expect some volatility during the transition period from one administration into the next, but buy-and-hold investors could be rewarded over the next several quarters and beyond.

From a macro point of view, we keep getting evidence that business sentiment is slowly improving. The NFIB Small Business Optimism Index in October matched the reading from this past July, which is back to its highest level since early 2022. Part of this could be a bump from anticipation of the election results, but it’s encouraging to see sentiment for this group beginning to hold sustainably above the levels of recent years. Also, the latest Senior Loan Officer Opinion Survey from the Fed showed industrial and commercial loan demand stagnant quarter-over-quarter. That doesn’t sound terribly positive, but it’s the first time in the past two years that we didn’t see loan demand declining. If loan demand is indeed bottoming here, it would be a good sign that the soft landing narrative is still intact.

I am concerned though about conditions pivoting before the end of the year. A lot of folks are going to be banking on seasonality helping to push stock prices higher, but the reaction of the bond market and the fact that budget deficits, the debt and inflation risks are likely going to be problems moving forward could spook investors as we approach Inauguration Day. Trump is already planning aggressive action as soon as he’s sworn in and that may result in a sentiment shift sooner rather than later.