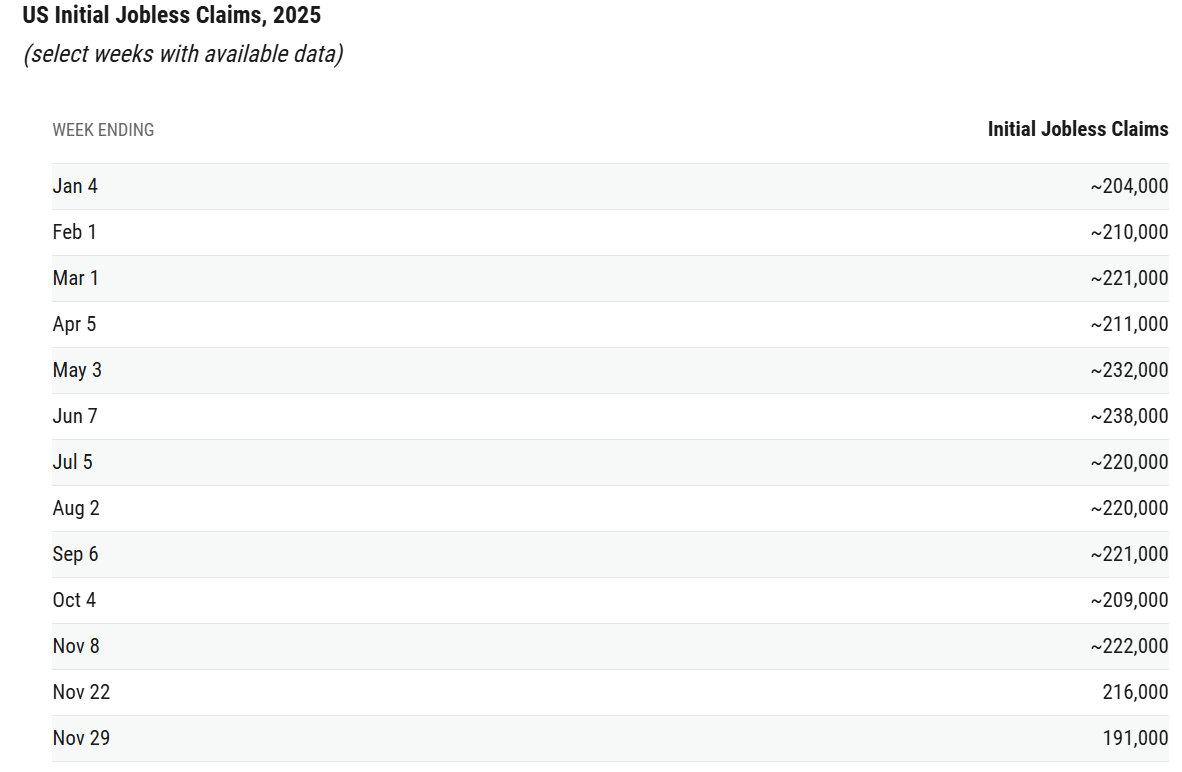

Markets are ending 2025 in an uneasy balance, pulled between pockets of resilience and accumulating signs of fatigue. With the federal shutdown delaying official labor data, investors relied on private indicators to make sense of the economy. That produced one of the week’s strangest divergences. Jobless claims fell to 191,000 — a three-year low.¹ Yet alternative datasets suggested the economy shed jobs in November.¹ The S&P 500 drifted sideways on the news, still up double digits for the year.

Source: YCharts

Europe offered a more straightforward storyline. The eurozone composite PMI reached a 30-month high.² Inflation eased to 2.2%, essentially matching the ECB’s target.³ The UK remained the inflation outlier with CPI stuck at 3.8%, the highest in the G7, raising expectations for another BoE cut.⁴ Japan moved in the opposite direction: new fiscal spending and firmer exports strengthened the case for the Bank of Japan to consider its first meaningful rate hike in years.⁵

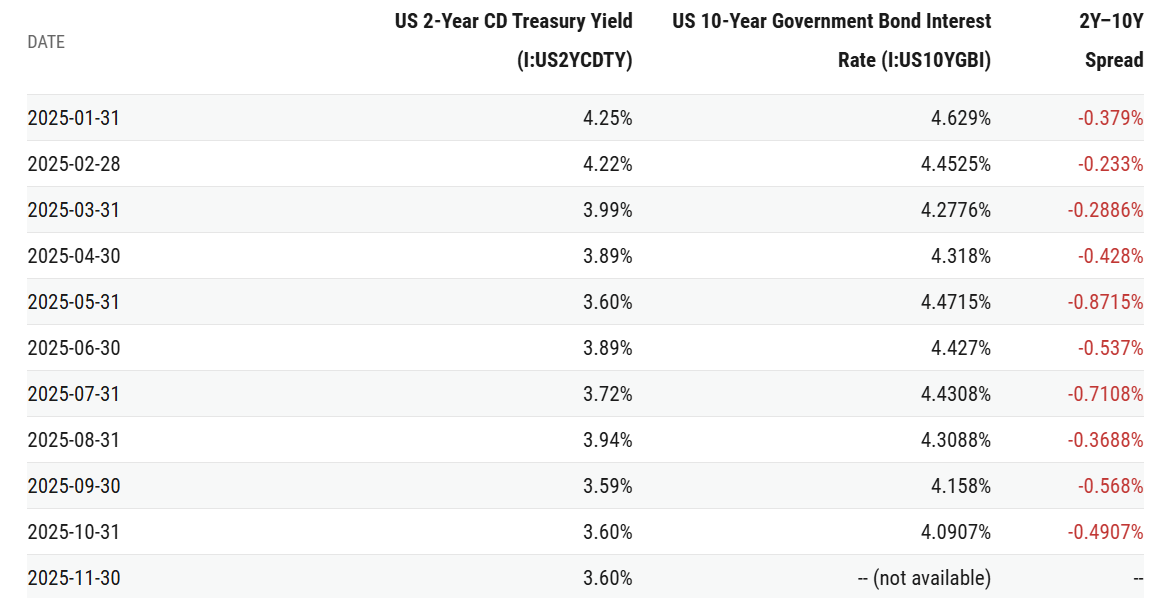

Cross-asset flows reflected similar tension. Money-market assets climbed to a ten-month high as investors sought safety.⁶ Yet global equities still attracted inflows. The U.S. yield curve remained roughly 50 bps inverted.⁶ Currency markets added drama: the dollar softened on expectations of Fed easing, while the yen briefly spiked as traders priced in BoJ tightening before retreating.⁷ ⁸

U.S. Macro & Market Backdrop

With official data delayed, investors were left to decipher contradictory labor signals. Revelio Labs estimated job losses in November even as jobless claims hit their lowest reading since 2022.¹ Layoff announcements, which had surged in October, fell sharply.¹ The overall impression: an economy cooling unevenly, not collapsing.

Expectations for rate cuts hardened quickly. Fed funds futures now imply an 85% chance of easing at the December meeting.⁷ Reports that the White House is considering a more dovish successor to Chair Jerome Powell strengthened that view.⁷ Treasury yields drifted lower, with the 10-year near 4% and the 2-year around 3.5%, maintaining a modest inversion.⁶

Source: YCharts

Equities reflected that uncertainty. After a strong autumn, the S&P 500 stalled on low volume. Defensive sectors such as utilities and healthcare outperformed, while high-beta names softened. With earnings decelerating and the Fed’s path shifting, markets appear to be waiting for clearer direction from both incoming data and policymakers.

Developed Markets

Europe

The eurozone continued to outperform expectations. The composite PMI climbed to 52.8.² Inflation hovered near target.³ ECB officials expressed confidence that inflation is “largely defeated”.³ Markets do not expect rate cuts until late 2026.³ Unemployment remains low, and surveys point to an economy holding up better than feared.³

United Kingdom

Britain’s inflation challenge persists. CPI held at 3.8%.⁴ Services inflation remains elevated.⁴ The Bank of England, having already cut rates five times since August 2024, now sits at 4.0%.⁷ Markets expect another cut soon. Fiscal tightening introduced in November may ease inflation next year, though household inflation expectations remain high.⁴

Japan