The first half of 2024 wrapped up on Friday with total returns looking a lot like they have for the past 18 months - tech & communication services in the lead, mega-caps dominating and long-term Treasuries still in the red. Over the past several weeks, however, it remains a very fragmented market. Tech controlled the market pretty much on its own for two straight weeks and, while it’s backed off again lately, there’s nothing that’s really stepped up in its place. Small-caps had good days here and there. Energy and other cyclicals had their moments. Overall, though, there’s still a real lack of breadth, few outperformers and a lot of questions surrounding where the markets are headed next.

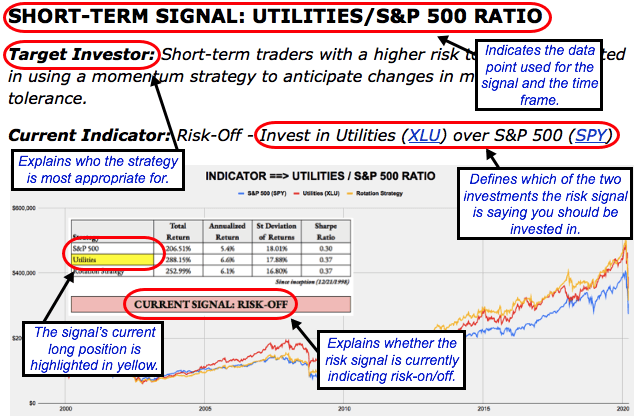

How To Interpret the Signals: Within each strategy, there is a risk-on and risk-off investment recommendation, with the risk-off option being the more conservative of the two. When a particular signal indicates that investors should be risk-off, for example, subscribers should consider investing in the risk-off option and avoiding the risk-on option. The opposite, therefore, would be true when the signal flips to risk-on. In each strategy, you’d always be invested in one option or the other.

Here’s how to read the scorecard for each strategy:

Some of the strategies will be more aggressive than others. The “Leverage For The Long Run” strategy, for example, uses the S&P 500 and 2x-leveraged S&P 500. The more conservative “Lumber/Gold Bond” strategy, however, uses intermediate-term Treasuries and the S&P 500. In every case, a risk-off signal indicates that you should be invested in the more conservative of the two options, while a risk-on signal indicates you should be invested in the more aggressive one.

For a full user's guide on how to interpret each of the signals and how to put them to work in your portfolio, please click HERE.

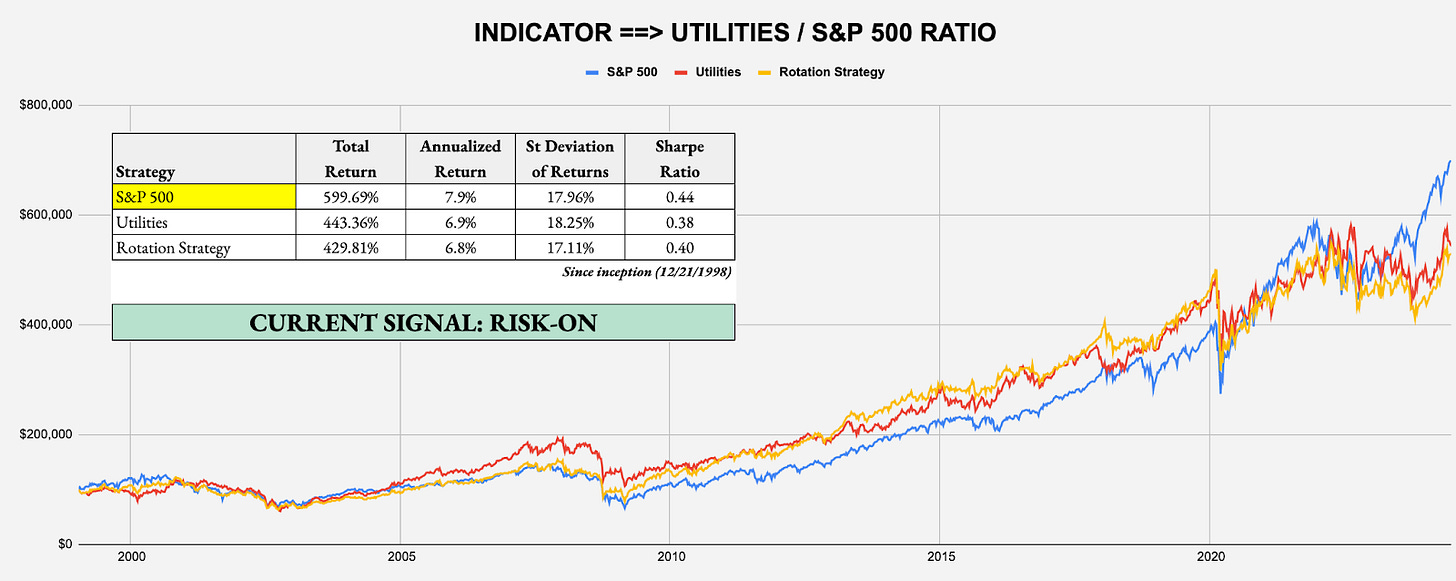

SHORT-TERM SIGNAL: UTILITIES/S&P 500 RATIO

Target Investor: Short-term traders with a higher risk tolerance interested in using an equity momentum strategy to anticipate changes in market risk tolerance.

Current Indicator: Risk-On

Strategy: Beta Rotation - Example: Invest in S&P 500 (SPY) over Utilities (XLU)

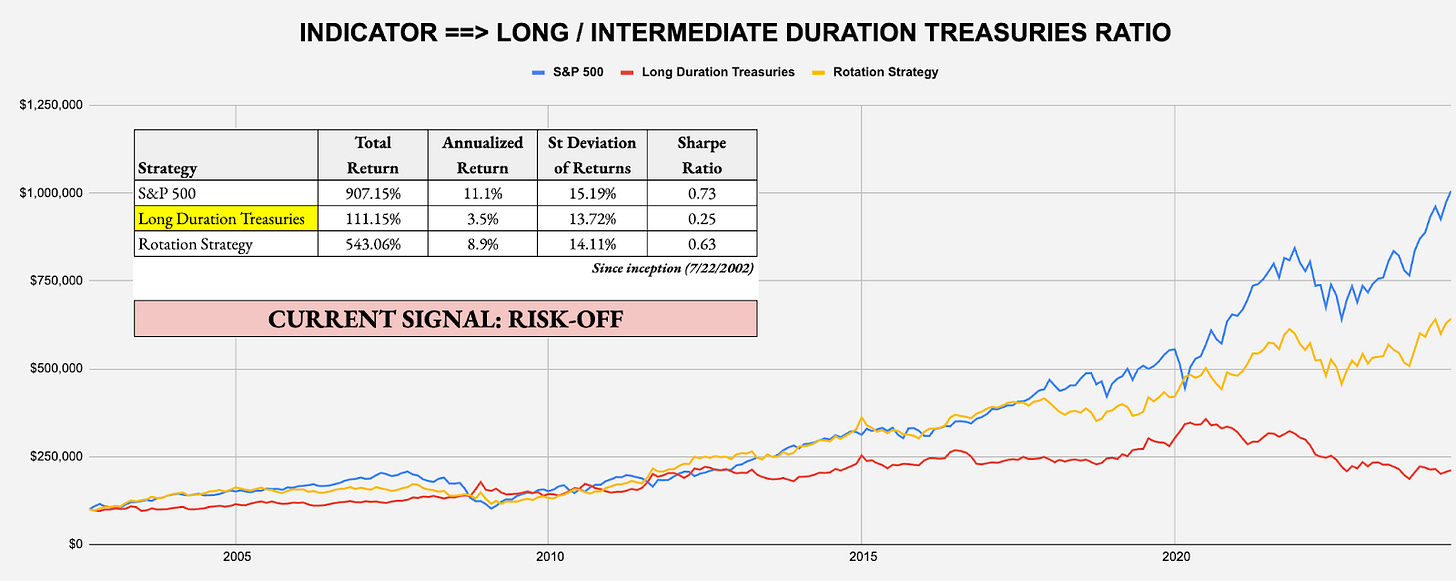

SHORT-TERM SIGNAL: LONG DURATION/INTERMEDIATE DURATION TREASURIES RATIO

Target Investor: Short-term traders with a higher risk tolerance who want to use the activity in the U.S. Treasury market to judge overall risk levels.

Current Indicator: Risk-Off

Strategy: Tactical Risk Rotation - Example: Invest in Long-Duration Treasuries (VLGSX) over S&P 500 (SPY)

INTERMEDIATE-TERM SIGNAL: LUMBER/GOLD RATIO

Target Investor: Short- and long-term investors willing to trade more frequently using the classic cyclical vs. defensive asset comparison.