Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: WHY SMALL-CAPS COULD BE TELLING US THAT THIS RALLY ISN’T AS STRONG AS IT SEEMS

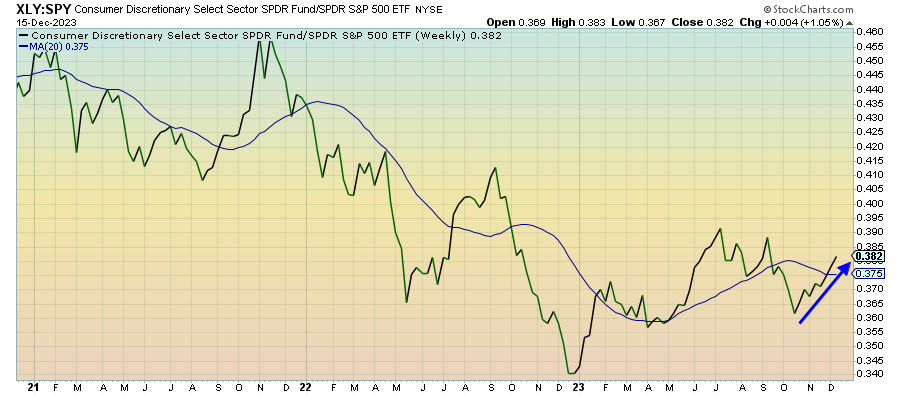

Consumer Discretionary (XLY) – Building On Recent Momentum

Discretionary stocks continue building on the momentum of the past two months that’s featured a strong bullish sentiment for cyclically sensitive areas of the market. The data right now is telling us that the labor market is still holding up, consumers keep spending and the drop in long-term interest rates is easing some of the immediate financial pressures. All of that is adding up to a short-term positive narrative for the retail names.

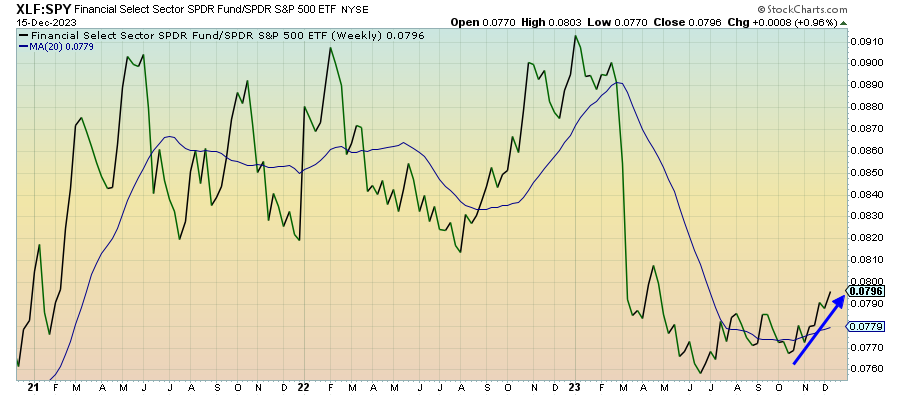

Financials (XLF) – The Dark Cloud Remains

Another big beneficiary of falling rates has been the financials, which are stringing together their best run since the 2nd half of 2022. At a macro level, the credit contraction is the biggest long-term threat to the sector, but investors are reacting currently to how margin pressures are declining due to the rate decline. The longer-term dark cloud is still hanging over this sector.

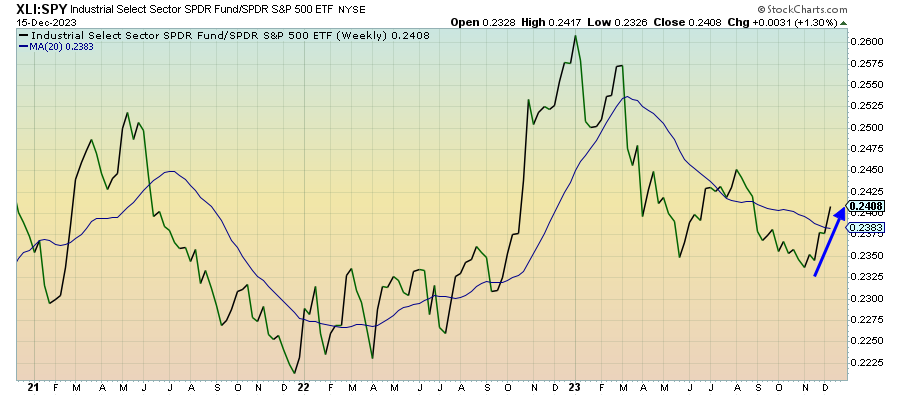

Industrials (XLI) – Remember Why The Fed Pivots In The First Place

Sentiment for industrials is about as strong as it’s been since the 2nd half of 2022, but it’s also incredibly overbought. In that way, it’s not different from a lot of cyclical strategies right now, but it’s also benefiting from a state of investor exuberance. I think it’s important to remember here that the Fed begins cutting rates because they see cyclical weaknesses ahead and rallies tend to be short-term in nature.

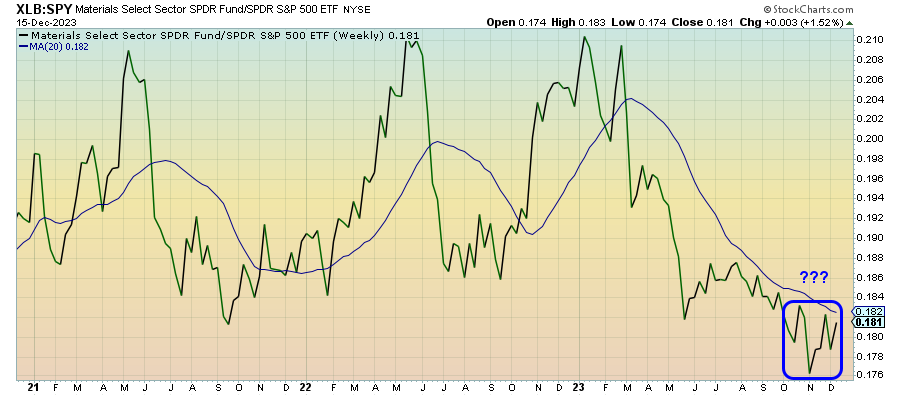

Materials (XLB) – Volatile Without Direction

Materials stocks seem to reverse course on almost a weekly basis, leaving them volatile but without direction. With energy also struggling here amid an environment of falling oil prices, the cyclical rally is being driven pretty much only by manufacturers and lenders, not the underlying commodity producers.

Real Estate (XLRE) – Low Demand, Lower Supply