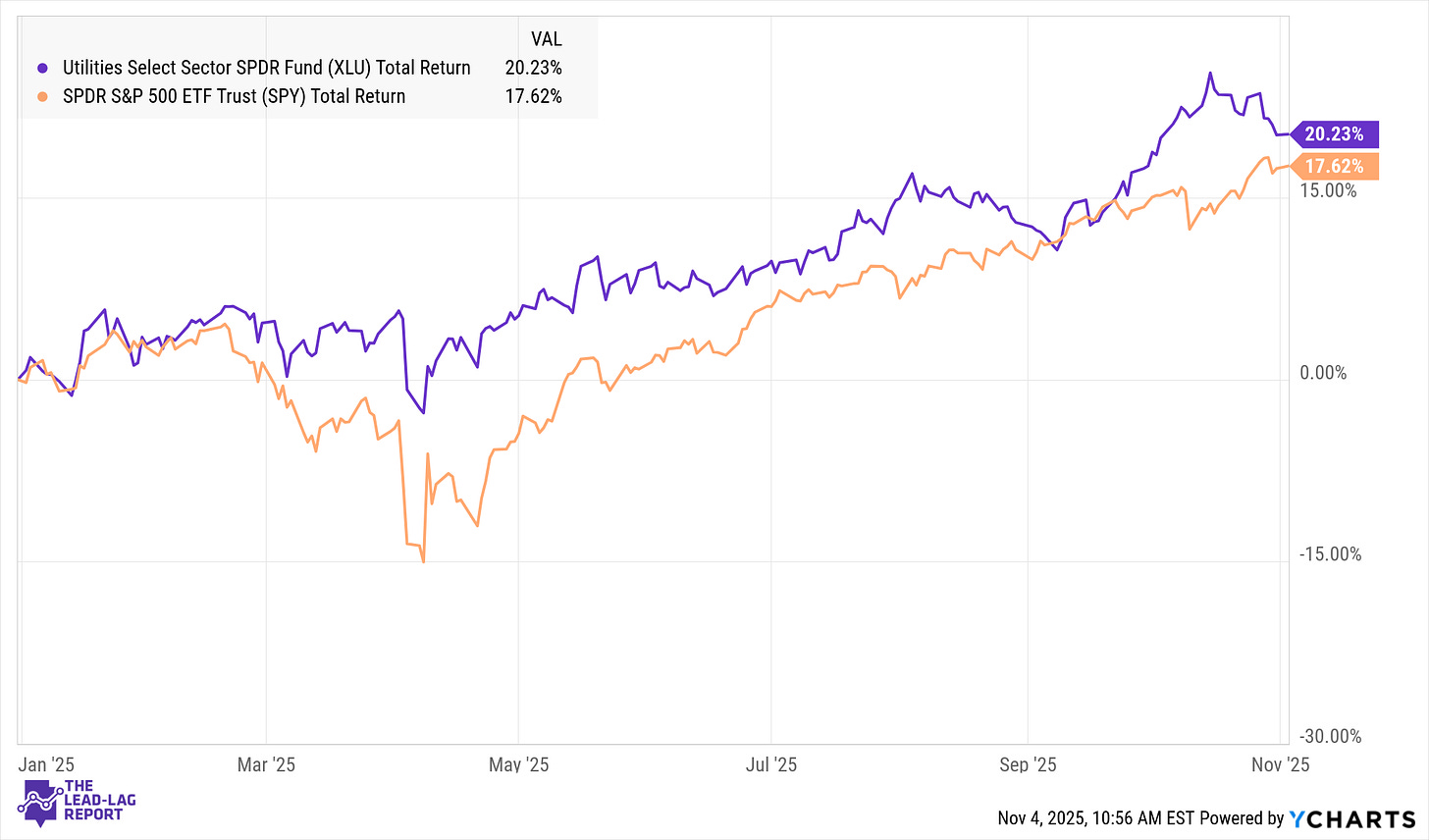

The U.S. Utilities sector has outperformed the broader market for most of 2025. As of early November, the Utilities Select Sector ETF (XLU) is up roughly 20% in total return versus 17% for the S&P 500 (SPY)—an apparent lead that masks a volatile year.

Despite their reputation as stable, dividend-rich assets, utilities have been overshadowed by high-growth technology names. The sector’s total market capitalization, roughly in the low trillions, is small compared with megacap tech—reinforcing its “under-the-radar” status. Meanwhile, persistent macro headwinds—elevated rates, sticky inflation, and regulatory uncertainty—have weighed heavily.

Why Utilities Aren’t Up More Despite AI Optimism

While the power boom coming from AI is a powerful tailwind, there are still other factors that weight on performance.

High Interest Rates. Utilities are capital-intensive, and financing remains costly with 10-year Treasury yields above 4%³. Even modest Fed cuts have done little to reduce long-term borrowing costs.

Policy Ambiguity. The current administration has not clarified whether the 2022 Inflation Reduction Act’s energy tax credits will be renewed or modified⁴. Uncertainty over carbon pricing and permitting rules further clouds the outlook.

Muted Power Demand. Electricity usage outside of data centers and EV charging remains tepid. While AI workloads are surging in select regions, overall consumption is growing slowly.

Exploding Capex. Utilities are pouring capital into grid upgrades and new generation projects. Construction timelines now stretch three to seven years, and plant costs have tripled to about $2,400 per kilowatt⁵. Free cash flow has tightened even as balance sheets stay levered.

Investor Rotation. With volatility low and growth stocks in favor, defensive sectors have seen outflows. As one analyst put it, the recent drop in utilities “implies investors are comfortable shifting into cyclical and growth stocks”⁶.

Valuations Near Historical Lows

This persistent underperformance has left utilities cheap by most metrics. The sector trades around 19–20× forward earnings⁷⁸, below the S&P 500’s 21–22× multiple and near the lower end of its decade-long range. EV/EBITDA ratios hover near 13×⁹—discounted relative to the broader market—and XLU’s price-to-book is just 0.94×⁸, implying assets valued below replacement cost.

In essence, investors are paying low multiples for stable, regulated cash flows. Historically, such valuation gaps have coincided with forward outperformance once sentiment normalizes.

Catalysts for a Reversal

Several potential shifts could bring utilities back into focus as a major potential top performer.