Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

Normally in this space I talk about a fund, usually a closed-end one, that presents a high yield opportunity for investors. This week, I’m going to do something a little different.

As I was scrolling through my news feed, I noticed that the abrdn Japan Equity Fund (JEQ) announced a proposed merger with the abrdn Global Infrastructure Income Fund (ASGI). If the idea of two funds “merging” sounds a little odd, it’s unusual in the CEF world, but not necessarily rare. These funds are organized as investment companies, so technically they can merge just as any two ordinary companies could. But it raises questions for investors.

This week, let’s dive into the world of fund mergers. We’ll examine why it’s happening and what it means for existing & potential shareholders.

Fund Background

In its original form, JEQ’s goal was to outperform over the long-term the total return of the Tokyo Stock Price Index ("TOPIX"), a composite market-cap weighted index of all common stocks listed on the First Section of the Tokyo Stock Exchange.

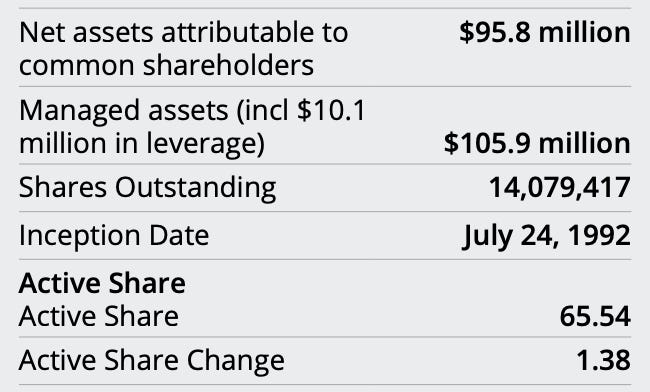

With just short of $100 million in net assets (and a slightly higher level of managed assets due to the 10% use of leverage), JEQ would be large enough, under normal circumstances, to warrant remaining open. Funds with tiny asset bases, especially ETFs, can be shuttered due to their lack of operational profitability. But that usually only becomes a consideration with assets of around $20 million and under. Plus, CEFs are structurally different from ETFs, so closing them isn’t nearly as simple.

Despite this, the fund announced the proposed merger that would have shareholders of record as of March 14th voting on whether to approve it or reject it. This meeting is currently scheduled to take place on June 13th. If approved, the merger will officially take place sometime in Q3 of this year.

One of the terms of the merger would be that up to 50% of the available shares outstanding of JEQ could be sold for 98% of the fund’s NAV. This is to provide a chance for existing shareholders to exit at a predetermined price prior to the merger. The fund is also suspending its managed distribution.

Here is a rough list of benefits and drawbacks of the proposed merger.