The markets have fixated on September's potential Fed rate cut with probabilities shifting dramatically. Currently, investors see a 76% chance of a rate reduction, down from more than 95% just a week ago. These expectations will drive everything from equity valuations to borrowing costs.

Powell's Jackson Hole speech looms as the critical inflection point. What seemed certain just weeks ago now carries more uncertainty than initially priced in. The base case remains a 25-basis-point cut that would bring the Fed Funds rate from its current 4.25%-4.50% range down to 4.00%-4.25%.

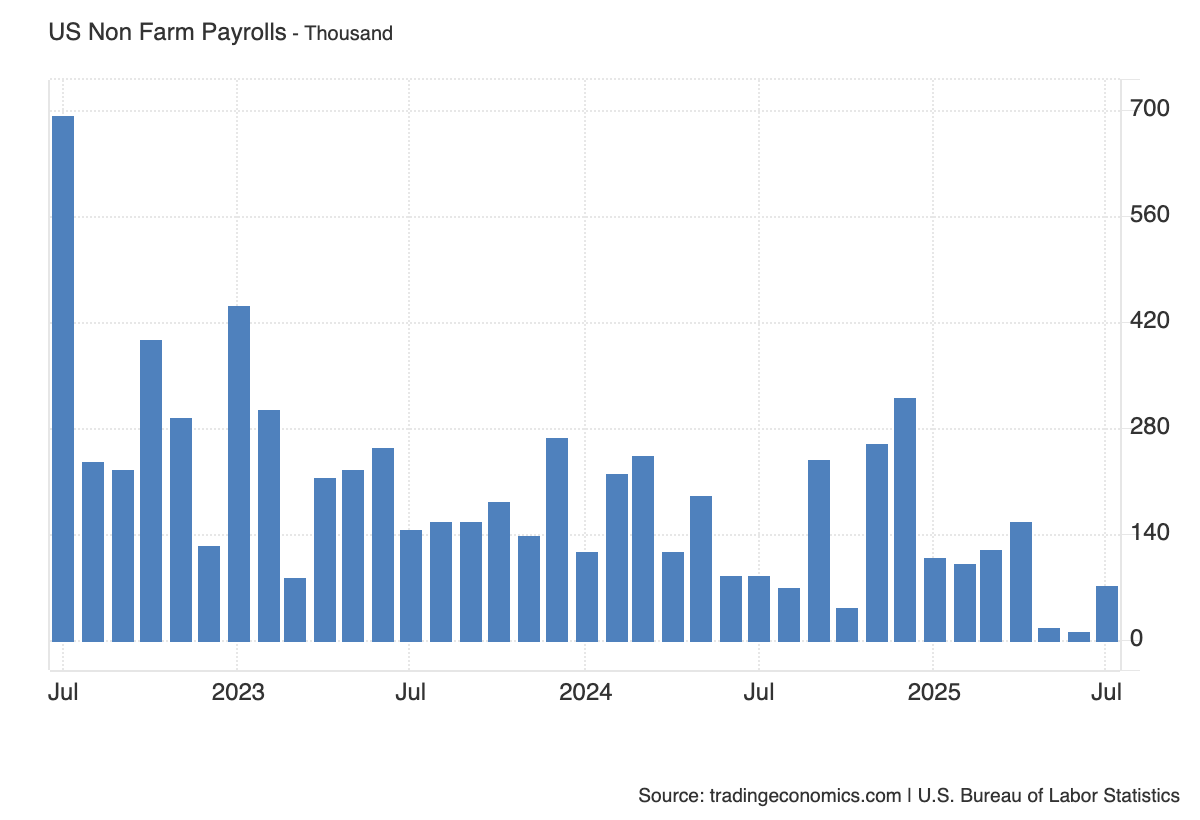

The economic data tells two contradictory stories. Core inflation runs more than a full percentage point above the Fed's 2% target. July's employment report also delivered just 73,000 new jobs, well short of the expected 110,000 and that’s not even considering the massive downward revisions. These mixed signals make Fed policy decisions genuinely difficult.

The market has responded too. The S&P 500 has closed lower on five straight trading days, although it’s still only about 2% below its all-time high.

What makes this Jackson Hole address different? The opposing forces at play are more pronounced than usual. Core inflation jumped to 3.1% year-over-year, though most investors will focus on the headline rate holding steady at 2.7%. The three-month average for job gains has dropped to just 35,000, suggesting the labor market may be weakening faster than the headline unemployment rate of 4.2% indicates.

The question still isn't whether the Fed cuts anymore. It's about timing, magnitude and what comes after September. Bank of America already shifted its forecast, now expecting rates to hold steady longer, citing tariff pressures and persistent inflation as reasons policy might stay tighter.

Key Economic Signals Shaping the Fed's Decision

Powell faces a genuine problem as he crafts his Jackson Hole message. The economic data doesn't tell a clean story in either direction, making the Fed's policy path far more uncertain than market pricing suggests.

Let’s start with labor market contradictions. Unemployment remains low at 4.2%, yet job creation has decelerated sharply. Initial jobless claims have crept higher over several weeks and continuing jobless claims remain much above average compared to the past couple years. This suggests cracks developing beneath the surface. That three-month average of just 35,000 jobs added should have Fed officials paying attention.

Consumer spending continues to hold up better than expected. Recent retail sales data has come in above consensus, indicating households still have the capacity and willingness to spend. The housing market is beginning to show the kind of rate-sensitive weakness you'd expect when borrowing costs stay elevated for extended periods. The US ISM manufacturing PMI readings have been contracting throughout 2025, showing industrial production remains under pressure.

The global context adds another layer of complexity. Both the European Central Bank and Bank of Canada have already started their cutting cycles, putting additional pressure on the Fed to follow suit. Geopolitical tensions have driven money toward safe-haven assets, creating distortions in the bond market that complicates the Fed's assessment of underlying economic conditions. And let’s not ignore the pressure coming from the White House to cut rates quickly and sharply!