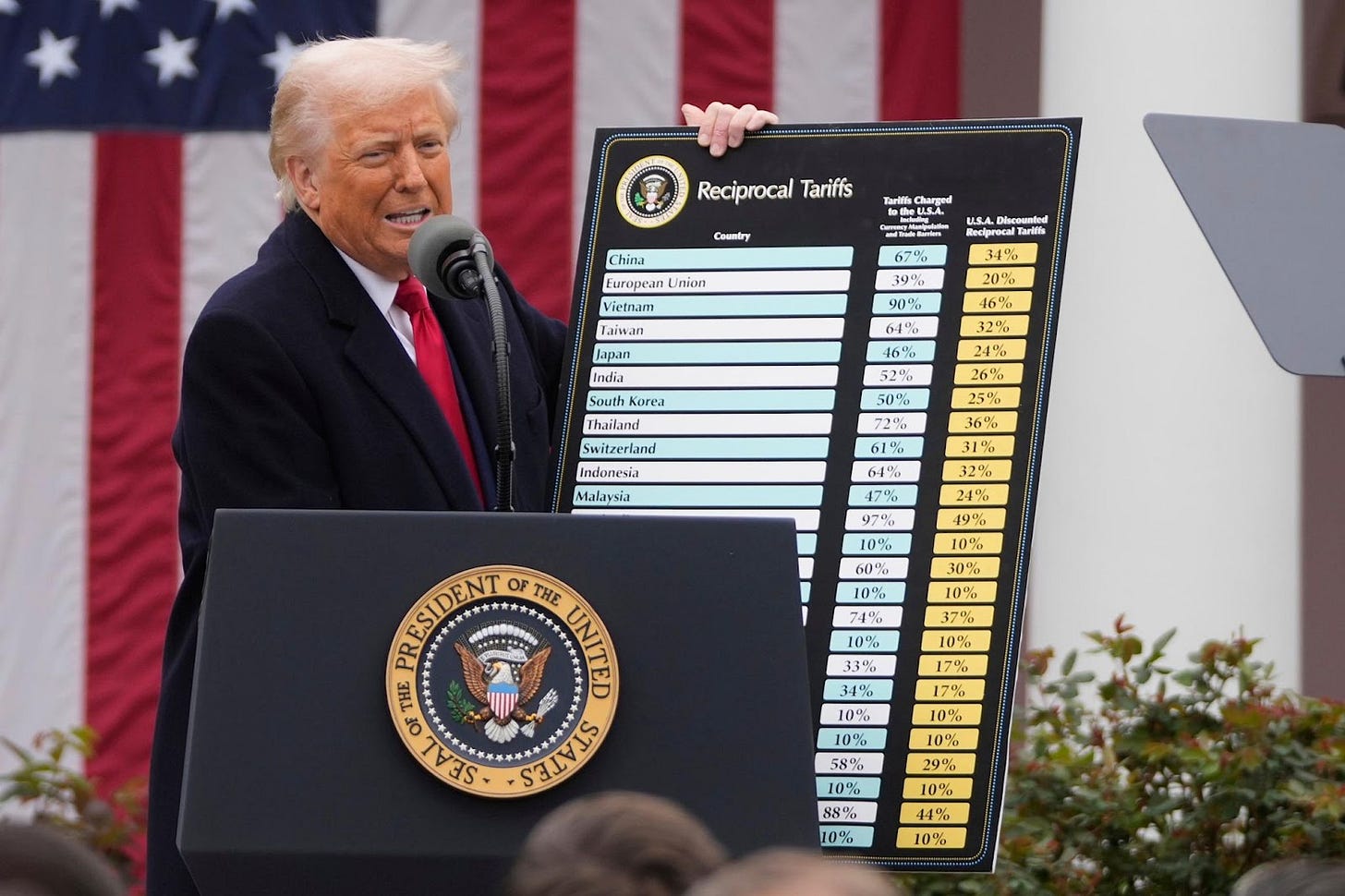

The markets were dealt a bit of a surprise this week when the U.S. Court of International Trade blocked President Trump from imposing his sweeping reciprocal tariffs under the 1977 International Emergency Economic Powers Act only for an appeals court to reverse the ruling 24 hours later.

What that means for tariffs is up in the air, but we know that the current stay is only temporary and the Trump administration has until June 9th to file the necessary paperwork in order to proceed with next steps.

Leaving the politics of the situation out of it, if the Trump tariffs were to be blocked indefinitely, it would mark a sharp reversal in his economic policy plans. Going back to his first term, he’s long favored using tariffs as a means of leverage for getting what he wants. It gets framed as a way of generating money for the United States. This is technically true since the tariffs collected go to the U.S. Treasury, although those tariffs are paid by U.S. importers. If his tariffs do remain blocked indefinitely, it could reframe the economic outlook moving forward.

There were some interesting market reactions and insinuations that could be taken away from this:

U.S. Stocks Barely Moved

In isolation, you’d think that a sudden halt in the Trump tariffs, the one thing that has consistently moved the market for the past two months and longer, would be warmly welcomed by the market. U.S. stock prices moved higher right out of the gate, but then pulled back to relatively unchanged. Even following news of the stay that would put tariffs temporarily back on, the S&P 500 and Nasdaq 100 finished the day with only minor gains. Even the VIX barely moved, which suggests that the market largely took the developments in stride.

This suggests that easing trade tensions and an unlikelihood that the more punitive tariffs would stick were already largely priced into the market. But the reversal also didn’t generate much of a reaction. Maybe the market is tired of this. Maybe it thinks there’s no point in reacting because things are probably going to change again soon anyway. Either way, it’s a significant departure from the earlier market reactions to trade war developments, which saw U.S. stocks typically move several percent in either direction.

An indefinite pause on tariffs, however, could reframe the U.S. economic outlook a little differently. If reciprocal tariffs end up getting pulled off the table and the markets remain flat, it means there’s probably little upside left from reduced trade tensions. On the other hand, if Trump finds another way or form to re-introduce tariffs or gets the order thrown out permanently, the markets could move sharply lower. On a purely trade war point of view, risk/reward is tilted to the downside.

Treasury Yields Rose & Then Retreated

The initial reaction of the 10-year Treasury yield rising posed an interesting thought experiment. Reduced tariffs should be disinflationary, so why were long bond yields still rising?

It could have been an initial risk-on reaction by the markets - stock prices jumped at the open, so bond prices fell. It could have also been because the markets were still focused on the federal debt and the implications of it.

Special Announcement

Gain flexibility, precision, and control from the original EM ex-China ETF. All for 16 basis points.1

In today’s political and regulatory environment, many investors are looking to control exposure to China while maintaining a diversified, global portfolio.

Columbia EM Core ex-China ETF (XCEM) provides exposure to emerging market equities while excluding companies headquartered in China and Hong Kong.

Pair XCEM with a China-specific investment to maintain total emerging markets exposure or avoid China-based companies altogether without losing exposure to fast growing markets such as Taiwan, South Korea, India and Brazil.

1 Net and gross expense ratio. The fund’s expense ratio is from the most recent prospectus.

Carefully consider the funds' investment objectives, risk factors and charges and expenses before investing. This and other information can be found in the fund‘s prospectus, which may be obtained by calling 888.800.4347 or by visiting the fund’s website www.columbiathreadneedleus.com/etf to view or download a prospectus.

Investing involves risks, including the risk of loss of principal. Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. The fund is passively managed and seeks to track the performance of an index. The fund may not sell a poorly performing security unless it was removed from the index. The fund may not track its index with the same degree of accuracy as would a fund replicating (or investing in) the entire index. There is no guarantee that the index will achieve positive returns. Risk exists that the index provider may not follow its methodology for index construction. Errors may result in a negative fund performance. The fund's net value will generally decline when the market value of its targeted index declines. Foreign investments subject the fund to risks, including political, economic, market, social and other risks impacting a particular country, as well as to currency instabilities and less stringent financial and accounting standards generally applicable to U.S. issuers. These risks are enhanced for emerging market issuers. Investment in or exposure to foreign currencies subjects the fund to currency fluctuation and risk of loss. Investments in small- and mid-cap companies involve risks and volatility greater than investments in larger, more established companies. The fund concentrates its investments in issuers of one or more particular industries to the same extent as the underlying index. Although the fund’s shares are listed on an exchange, there can be no assurance that an active, liquid or otherwise orderly trading market for shares will be established or maintained. Active market trading may increase portfolio turnover, transaction costs and tracking error to the targeted index. The Fund may have portfolio turnover, which may cause an adverse cost impact. There may be additional portfolio turnover risk as active market trading of the fund’s shares may cause more frequent creation or redemption activities that could, in certain circumstances, increase the number of portfolio transactions as well as tracking error to the Index and as high levels of transactions increase brokerage and other transaction costs and may result in increased taxable capital gains.

Shares are not FDIC insured, may lose value, and have no bank guarantee.

For broker/dealer or institutional use only.

Columbia Management Investment Advisers, LLC serves as the investment manager to the ETFs. The ETFs are distributed by ALPS Distributors, Inc., which is not affiliated with Columbia Management Investment Advisers, LLC, Columbia Management Investment Distributors, Inc. or its parent company Ameriprise Financial, Inc. Columbia Management Investment Distributors, Inc., LLC (Member FINRA | SIPC) is a marketing agent for the ETFs. Columbia Threadneedle Investments is the global brand name of the Columbia and Threadneedle group of companies.

DISCLAIMER – PLEASE READ: This is sponsored advertising content for which Lead-Lag Publishing, LLC has been paid a fee. The information provided in the link is solely the creation of Columbia Threadneedle. Lead-Lag Publishing, LLC does not guarantee the accuracy or completeness of the information provided in the link or make any representation as to its quality. All statements and expressions provided in the link are the sole opinion of Columbia Threadneedle and Lead-Lag Publishing, LLC expressly disclaims any responsibility for action taken in connection with the information provided in the link.

Here’s the case: If the Trump tax cut bill eventually passes, it creates a strain on the national debt and federal budget deficits. The tariffs would have brought another income source to the equation and potentially offset some of the fiscal strain introduced by the bill.

If tariffs are off the table, that should, in isolation, amplify the fiscal impact of the bill on the debt and deficits. Perhaps the bond market reacted to that by pushing yields higher on the belief that there might be less confidence in dollar-denominated assets ahead.

But even bond yields remained flat after the appeals court reinstated tariffs. It feels like neither the stock nor bond markets really know what to think at this point.

Trump’s Path Ahead

I don’t think there’s any question that Trump is going to try as hard as he possibly can to make these tariffs as permanent as possible, even going all the way to the Supreme Court if necessary. That will be path #1.

If that doesn’t work and the tariffs get blocked, there are a couple potential paths. He could attempt to reframe the situation as unfair trade practices instead of a national economic emergency. There might be a slightly better justification for this, but it would likely face legal challenges too considering it would almost certainly be viewed as just an alternate wording of the same thing.

Perhaps he tries to put restrictions around the import of foreign goods as opposed to a tax on them. This could have the effect of balancing out trade, although it would likely be met with reciprocal measures on the other side. Not to mention it wouldn’t really help the “Make America Rich Again” narrative.

He could keep using his new tactic of targeting and removing Chinese students as a means of returning the two sides to the negotiating table. He could add a lot of bureaucratic red tape to foreign imports to make them more difficult to onshore. There’s things that could be done, but they’re unlikely to have the fiscal impact that tariffs would.

It’s worth mentioning that the Trump tariffs are broadly unpopular, so their elimination may actually help him out in the long run.

Is Deregulation The Next Frontier For The White House?

There’s one potential path that doesn’t really involve trade or tariffs at all - deregulation. It’d be much easier to sign an executive order that limits the need for certain regulatory oversights, eases operating conditions or reduces the cost or need to remain in compliance.

Beyond that, it comes with three big benefits:

You get a big catalyst for accelerating U.S. economic growth.

You don’t run into the legal hassles that you’re likely to have with tariffs.

It avoids the optics of raising the debt or spiking inflation.

Granted, any of those things could happen with a deregulatory push, but the direct linkage wouldn’t necessarily be as obvious as it would be with tariffs.

Trump already has this on his agenda and it’s likely that some form of it is coming sooner rather than later. The blocking and reinstating of tariffs likely pushes the potential timeline for this out further into the future, but I suspect that if Trump finds that his tariff policy gets blocked indefinitely, deregulation emerges as the next option.

Final Thoughts

Trump probably prefers tariffs because he wants to stick it to other countries. Deregulation doesn’t necessarily do that, but it does serve to likely accelerate the economy’s growth trajectory. For a person who’s been pro-business his entire life, that’s probably still an attractive consolation prize.

Overall, I think the likelier outcome here is an environment where tariffs are either blocked or reduced. The era of tariffs on China of 50%, 100% or more is probably over. If that remains the case, I think the days of the VIX in the 40s are probably over too. The market seems to have settled on a state of acceptance for tariffs in the minor to modest range and it could take a major shift to really jolt the markets at this point. The reaction this week to some pretty significant policy events would seem to support this.

If this is the case, I see Trump pivoting to deregulation pretty quickly. This could be the catalyst for the next leg of economic growth.

The Lead-Lag Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by the Lead-Lag Report are independent of other services provided by Lead-Lag Publishing, LLC or its affiliates, and positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors and employees expressly disclaim all liability in respect to actions taken based on any or all of the information on this writing.