Key Highlights

Central bank divergence intensified into year-end. The Federal Reserve signaled a pause after its latest cut, while the Bank of Japan tightened further and European policymakers leaned toward stability rather than additional easing.

Market leadership broadened meaningfully. Small-cap and cyclical stocks outperformed as investors rotated away from stretched mega-cap technology, improving overall market breadth.

The U.S. economy cooled without cracking. Inflation continued to ease while labor market data softened, reinforcing expectations of a late-cycle slowdown rather than a sharp recession.

Europe surprised to the upside. Improving business activity and inflation near target allowed the ECB to hold rates steady, supporting the euro and stabilizing regional markets.

Emerging markets diverged sharply. India sustained strong growth momentum, Brazil benefited from earlier policy discipline, and China remained constrained by weak confidence and property stress.

Cross-asset signals pointed to normalization, not stress. Yield curves re-steepened, volatility stayed contained, and risk appetite improved, even as elevated cash balances reflected caution.

The final weeks of 2025 underscored how fragmented the global macro environment has become. While the Federal Reserve moved toward the sidelines after its latest rate cut, other major central banks pushed policy in different directions. Investors responded not by abandoning risk, but by shifting leadership within markets. As 2026 approaches, divergence—across monetary policy, regions, and asset classes—has replaced synchronization as the defining theme.

The Fed Pauses as Markets Reprice the Cycle

The Federal Reserve closed the year with a third consecutive rate cut, lowering the federal funds target range to 3.50%–3.75%. Chair Jerome Powell emphasized uncertainty and described policymaking as “driving through fog,” signaling that further easing is no longer automatic. Recent data support that caution. The U.S. unemployment rate climbed to 4.6% in November, its highest level in more than four years, even as payroll growth recovered modestly following an October slowdown.¹

Inflation trends have given the Fed room to pause. Headline consumer prices rose 2.7% year over year in November, the slowest pace since early 2021, while core inflation eased to 2.6%.² Together, softer inflation and cooling labor conditions suggest an economy decelerating toward trend rather than slipping abruptly into recession.

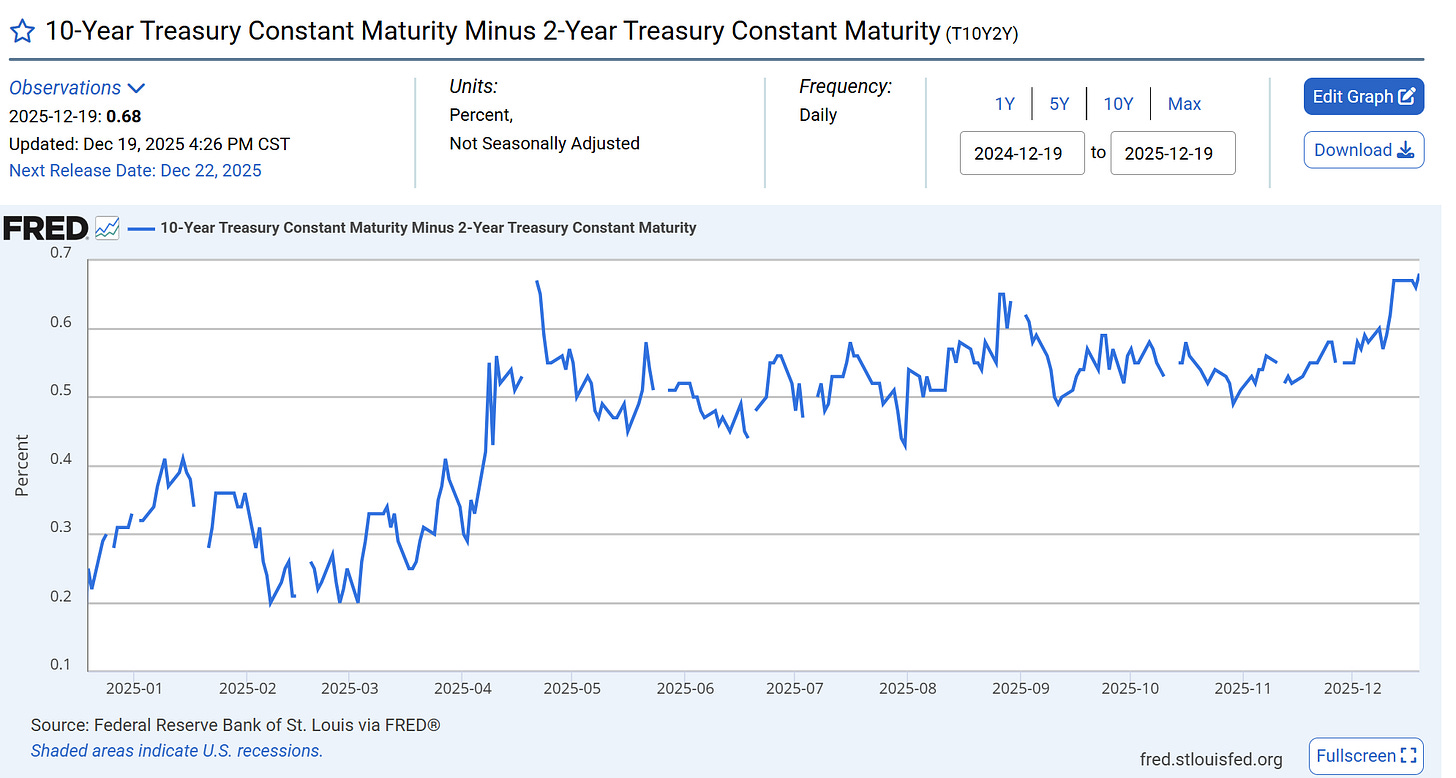

Bond markets reacted decisively. Treasury yields fell across the curve, and the long-running inversion finally reversed. The spread between 10-year and 2-year yields turned positive for the first time in over two years, reflecting expectations that policy is no longer restrictive enough to choke off growth.³ Equity markets absorbed the shift with relative calm. December trading proved choppy, but the S&P 500 still finished the year firmly higher, extending a multi-year run of strong performance.⁴

A Rotation Beneath the Surface

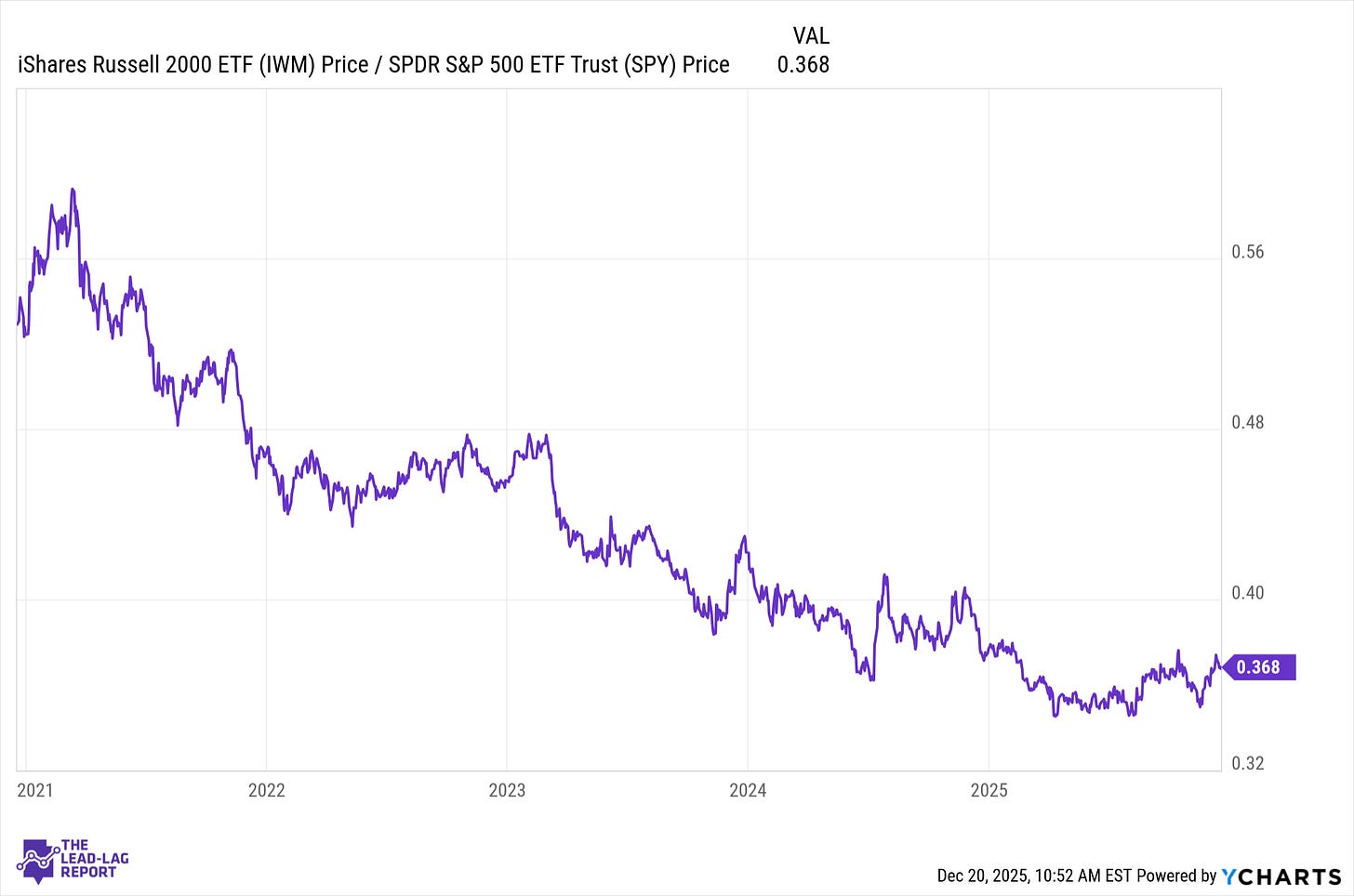

Beneath the surface of headline indexes, leadership shifted meaningfully. After years of dominance by mega-cap technology stocks, the fourth quarter saw investors rotate toward smaller companies and more cyclical sectors. Falling interest rates improved financing conditions for smaller firms, while stretched valuations in large-cap growth encouraged profit-taking.⁵

At the same time, enthusiasm around artificial intelligence began to cool. Investors grew more selective as questions emerged about the timing and scale of returns on massive AI infrastructure spending.⁶ The result was not a collapse in technology stocks, but a pause that allowed other segments of the market to participate more fully.

This broadening of participation matters. Rallies driven by a narrow group of stocks are inherently fragile, while advances supported by multiple sectors and styles tend to be more resilient. Increased contributions from small caps, industrials, and value-oriented areas suggest a healthier market foundation, even if the transition introduces short-term volatility.

Europe Finds Its Footing

Europe ended the year in better shape than many anticipated. Business activity surveys showed expansion at the fastest pace in more than two years, driven largely by a resilient services sector that offset ongoing manufacturing weakness.⁷ Inflation across the eurozone has largely converged with the European Central Bank’s target, giving policymakers confidence to hold rates steady after a year of easing.⁸

At its December meeting, the ECB left policy unchanged and upgraded its growth outlook, signaling that the disinflation phase is largely complete.⁹ This steady stance helped support the euro, which strengthened meaningfully against the dollar into year-end.¹⁰ Europe enters 2026 with improving momentum, inflation under control, and a central bank focused on maintaining stability rather than reigniting stimulus.

The United Kingdom and Japan Take Different Paths

In the United Kingdom, the Bank of England cut rates by 25 basis points after inflation fell faster than expected. The decision, however, revealed sharp divisions within the Monetary Policy Committee. Several members favored easing to support a stagnant economy, while others warned that inflation risks remain elevated relative to peers.¹¹ Markets now expect any additional cuts to be gradual and closely tied to incoming data.

Japan moved in the opposite direction. The Bank of Japan raised its policy rate to 0.75%, the highest level in three decades, marking another step away from ultra-accommodative policy. Policymakers expressed growing confidence that wage growth and inflation expectations are becoming self-sustaining.¹² Yet the yen weakened after the decision as investors concluded that further tightening would proceed slowly. Japan’s policy shift remains cautious, but its global implications are increasingly significant.