Donald Trump was inaugurated as the 47th president on Monday, but delivered little in the way of surprise announcements or policy implementations. Many of the executive orders signed on day one were largely expected, but the one with the potentially biggest impact - tariffs - was kicked down the road. That’s kept Tuesday’s market reaction fairly muted, but the tariff issue will likely still be faced very soon. It’s expected that Trump will impose 25% tariffs on Mexico and Canada as soon as February 1st. The impact of tariffs would likely be gradual, but tariffs are unquestionably an inflationary force, even if there’s an argument to be made that bringing business back to the United States is a good thing. Outside of gold prices still hanging around all-time highs, there hasn’t been much concern getting priced into the asset markets. Treasury yields are heading back down. There’s been no outperformance out of TIPS. Investors may need to be hit right in the face with evidence before pricing in this risk.

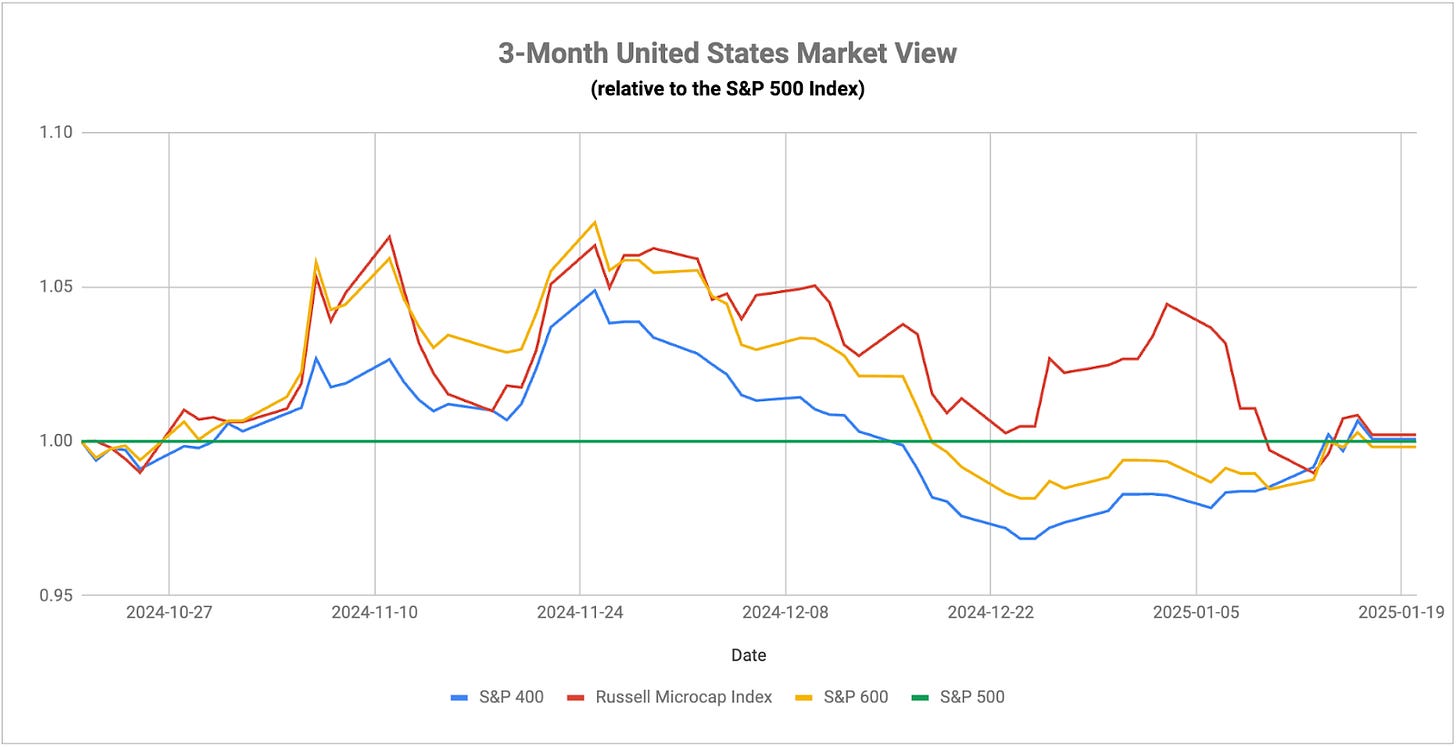

Trump’s agenda is no doubt business-positive, but I think the stocks may be having a more tepid reaction (the S&P 500 rose 3-4% in the immediate aftermath of the election but has been flat since) compared to his 2016 election because of how much of his agenda can actually be implemented. An extension of the Tax Cuts & Jobs Act legislation seems like a good bet, but it seems unlikely that he’ll be able to lower the corporate tax rate any further given the current trillion dollar budget deficits and soaring national debt. Global tariffs certainly have a “will he, won’t he” feel to them. The wave of executive orders on day one are already paving the way for a much easier regulatory environment, something that would benefit energy and financials more than anything. If you’re purely an equity investor, you want to see these things happen, but the collateral damage caused by them, specifically inflation and debt, are unclear.

Is manufacturing back? If the latest Philadelphia manufacturing index is an indicator, it sure is. It suddenly and surprisingly shot up to its highest reading since the post-COVID expansion and the 2nd highest reading in the past 40 years (new orders, shipments and employment also moved markedly higher). While I don’t think the manufacturing sector is necessarily doing THAT well, it does follow a trend that’s been developing over the past several months. The ISM manufacturing PMI has been rising since July and is at its highest level since last March. Industrial production has been growing again. It seems like there’s definitely been some improvement in the space, but how much is unclear. Remember, this is just a regional activity reading and other regions are still demonstrating struggles. While it’s still a relatively small piece of the U.S. economy, a recovery in manufacturing would have huge ramifications for the possibility that the global economy is recovering as well.

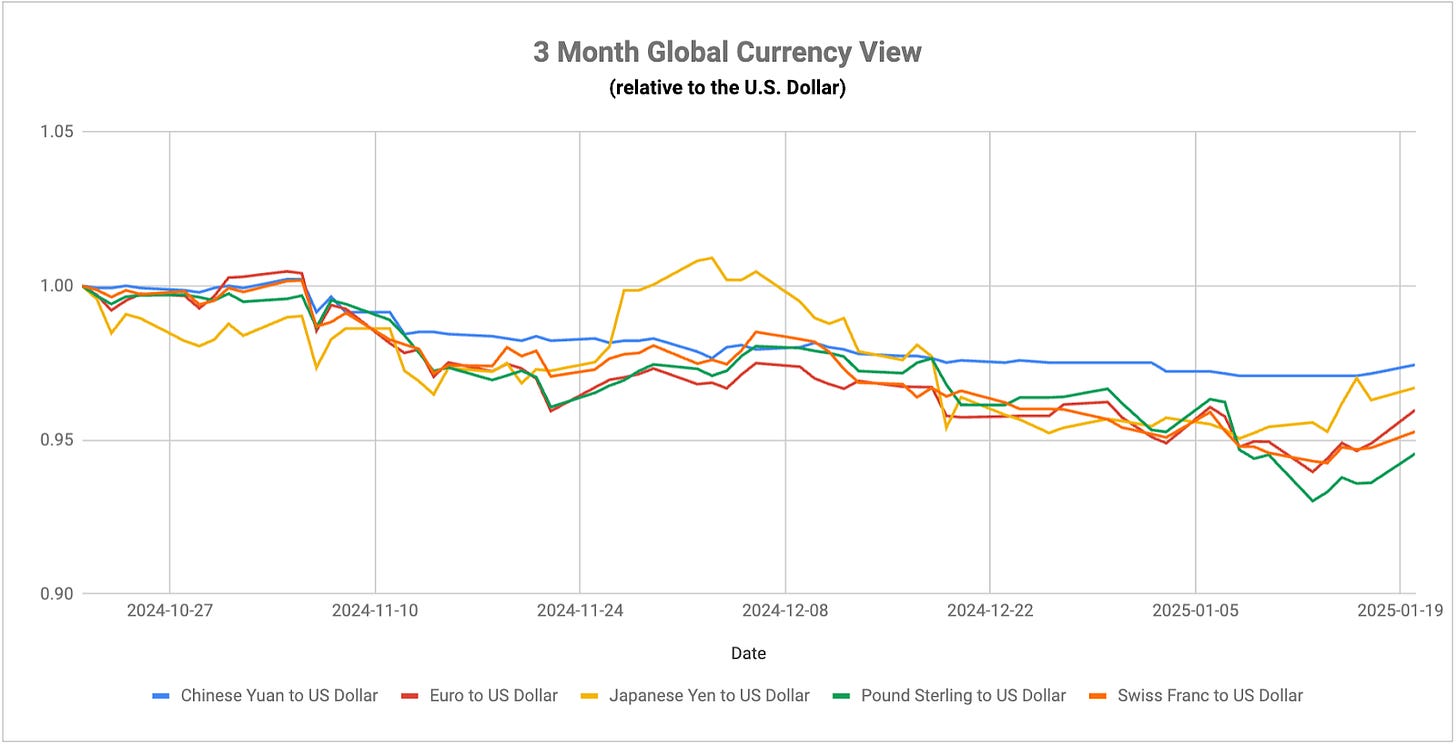

The big Bank of Japan meeting is on schedule for later this week and all the support is there for a quarter-point hike. Inflation is now tracking at a 3% annualized rate and has been above the BoJ’s 2% target since mid-2022. Wage growth has been running close to 3% annualized for the past six months, suggesting a sustainability to 2%+ inflation going forward. Members of the central bank have been making hawkish comments throughout the past several weeks, indicating that they’re probably comfortable at this point pulling the trigger. How it impacts the forex market is the big question. The yen should strengthen at the margins, but how much of it is already priced in? I’m guessing not nearly all of it, which makes this week’s likely hike a big source of potential volatility. If investors are distracted by the Trump inauguration and his policy path, this could deliver a negative jolt to the markets.

The United Kingdom continues to have a wage growth problem on its hands. It has executed two quarter-point cuts so far in the current cycle, but constant wage growth pressure could prevent the BoE from cutting further, at least in the near-term. Wages increased by 5.6% year-over-year in November, which marks the third consecutive month of increase. Wage growth had been slowing pretty consistently from mid-2023 to mid-2024, coinciding with a decline in annualized inflation. It's still running at mid-2% rate, which takes some pressure off of the BoE for now, but the reacceleration of wage growth is likely to translate to higher inflation around mid-2025. The BoE is still expected to cut rates again at its February meeting, but that may be the last one for a while. Stubborn and rising inflation will be a major headwind for both U.K. stocks and bonds in 2025.

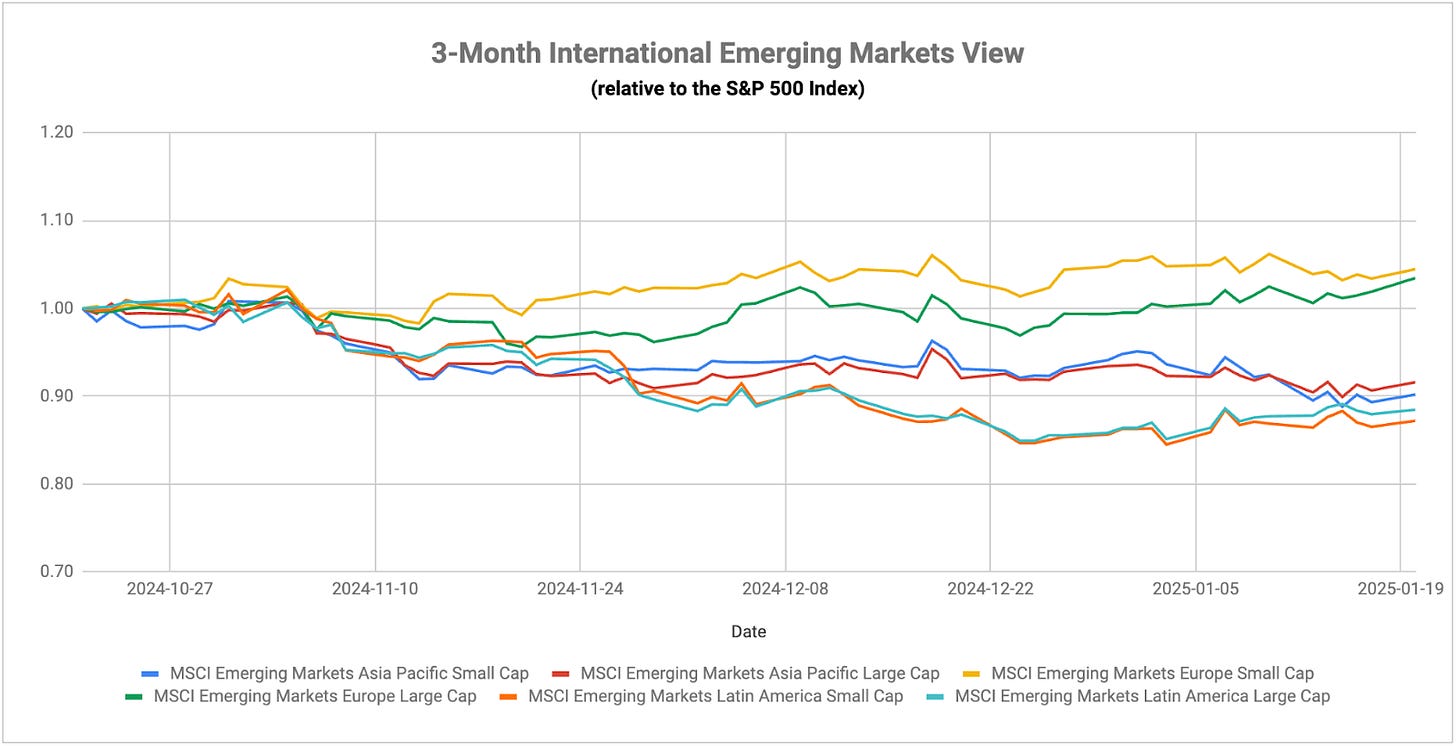

President Trump’s decision to bring TikTok back online and extend the deadline to find a buyer raises some questions about the future of the U.S./China relationship. Trump has spoken hawkishly about his intention to apply punitive tariffs to all Chinese imports, yet maintains a fairly friendly relationship with President Xi and is going to bat for an app that was originally banned due to national security concerns, which was upheld by the Supreme Court unanimously. Are tariffs going to be part of U.S. economic policy going forward or are they merely a negotiating and leverage tool? The fact that the Mexico and Canada tariffs were delayed despite expectations that they would be a day one thing suggests it’s the latter. Any delay or avoidance of tariffs would be a good thing for the economy and consumers since they’re really nothing more than an unnecessary tax on goods, but I think it’s worth wondering what the real long-term trade policy will actually end up looking like.

Special Announcement

Where Sophisticated Investors Access Private Markets

For individual investors, sourcing and vetting high-quality, sub-scale private market opportunities poses challenges – information asymmetry, adverse selection, insufficient resources, etc.

Enter 10 East.

10 East, led by Michael Leffell, allows qualified individuals to invest alongside private market veterans in vetted deals across private credit, real estate, niche venture/private equity, and other one-off investments that aren’t typically available through traditional channels.

Benefits of 10 East membership include:

Flexibility – members have full discretion over whether to invest on an offering-by-offering basis.

Alignment – principals commit material personal capital to every offering.

Institutional resources – a dedicated investment team that sources, monitors, and diligences each offering.

10 East is where founders, executives, and portfolio managers from industry-leading firms diversify their personal portfolios.

Join with complimentary access at 10east.co

DISCLAIMER – PLEASE READ: This is sponsored advertising content for which Lead-Lag Publishing, LLC has been paid a fee. The information provided in the link is solely the creation of 10 East. Lead-Lag Publishing, LLC does not guarantee the accuracy or completeness of the information provided in the link or make any representation as to its quality. All statements and expressions provided in the link are the sole opinion of 10 East and Lead-Lag Publishing, LLC expressly disclaims any responsibility for action taken in connection with the information provided in the link.

Also on the topic of tariffs, Trump this week threatened tariffs of 100% on imports from the BRICS nations - Brazil, Russia, India, China and South Africa - if they attempt to move away from the dollar as the currency standard. The fact that he incorrectly referred to Spain as a BRICS nation again doesn’t reinforce the notion that these are economic measures more than tools of threat. It doesn’t discount the fact that tariffs may eventually be enforced at some point, especially against some of the more economically vulnerable nations that can ill-afford a prolonged or punitive tariff battle, but it does suggest a lack of focus (for example, Trump targeted China with a 25% tariff early on before upping it to as much as 60% late last year and now 100% as part of this BRICS comment). That, in turn, could result in a delayed implementation until there’s more structure around what the White House intends to do. Bond yields and currencies are responding as if nothing is really imminent at this point, but volatility could be the key outcome.

Retreating Treasury yields and a lack of action on the tariff front resulted in a sharp dollar retreat for the first time since November. The delay of Canada/Mexico tariffs and the suggestion that the blanket tariffs he threatened earlier may be even further off, it’s beginning to look like the global trade war that the market had been preparing for might not be nearly as painful as thought. While that could reduce the chances of regional recessions in 2025, it’s likely to weaken the dollar. As mentioned earlier, I think we’re definitely looking at the possibility that tariffs are going to be more of a negotiating ploy than anything. If so, it could lead to potentially higher volatility ahead for the forex market as traders try to assess and reassess what will actually happen.

Speaking of volatility, the Bank of Japan meets later this week for what’s likely to result in a quarter-point rate hike. The yen has been strengthening modestly over the past two weeks, but I’d expect a rate hike announcement to give it a larger jolt. The yen currently is still far weaker than where it was during the August scare. That could mean there’s a lot more potential for a dollar/yen rate decline, but it could also mean that the market is less fearful this time around. The last reverse yen carry trade seems to have caught the market off-guard, but the current reaction seems to be more measured this time around. I’m still quite worried though that higher rates and tighter policy from the Bank of Japan combined with a potentially less impactful tariff policy could easily strengthen the yen quickly and pull equities lower in the process.

The Lead-Lag Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by the Lead-Lag Report are independent of other services provided by Lead-Lag Publishing, LLC or its affiliates, and positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors and employees expressly disclaim all liability in respect to actions taken based on any or all of the information on this writing.