Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: WE’RE STILL NOT RISK-ON YET

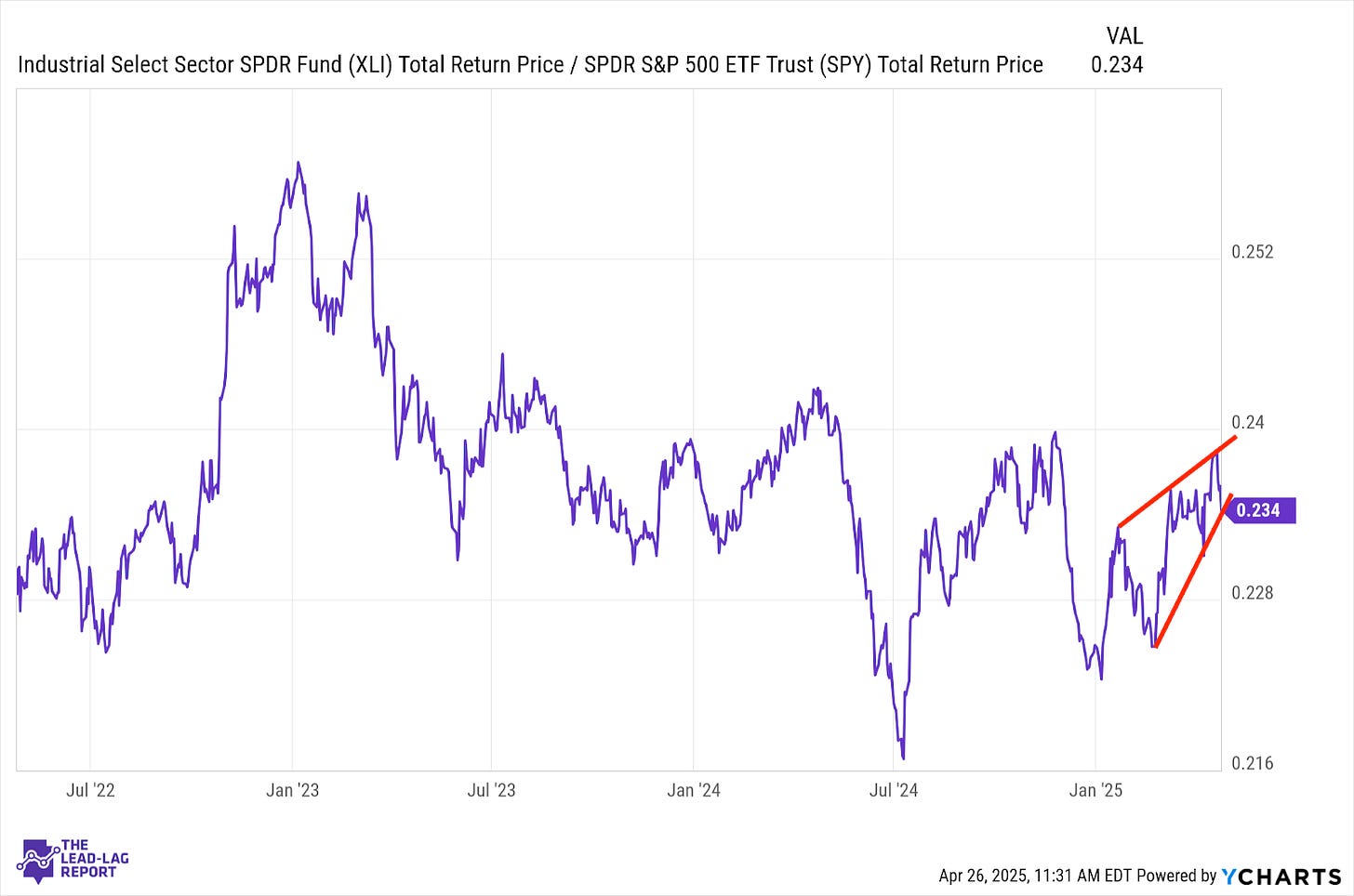

Industrials (XLI) – The Reversal Is Near

Cyclicals turned lower last week as short-term risk-on sentiment flooded the market, but I’m not sure this ratio is telling the real story. It may be more a function of mega-cap tech dragging the averages lower than cyclically-sensitive areas of the market outperforming. The backward-looking macro data is holding up so far, but we’re about to enter a period where Q1 earnings, jobs and Q1 GDP begin to change the narrative.

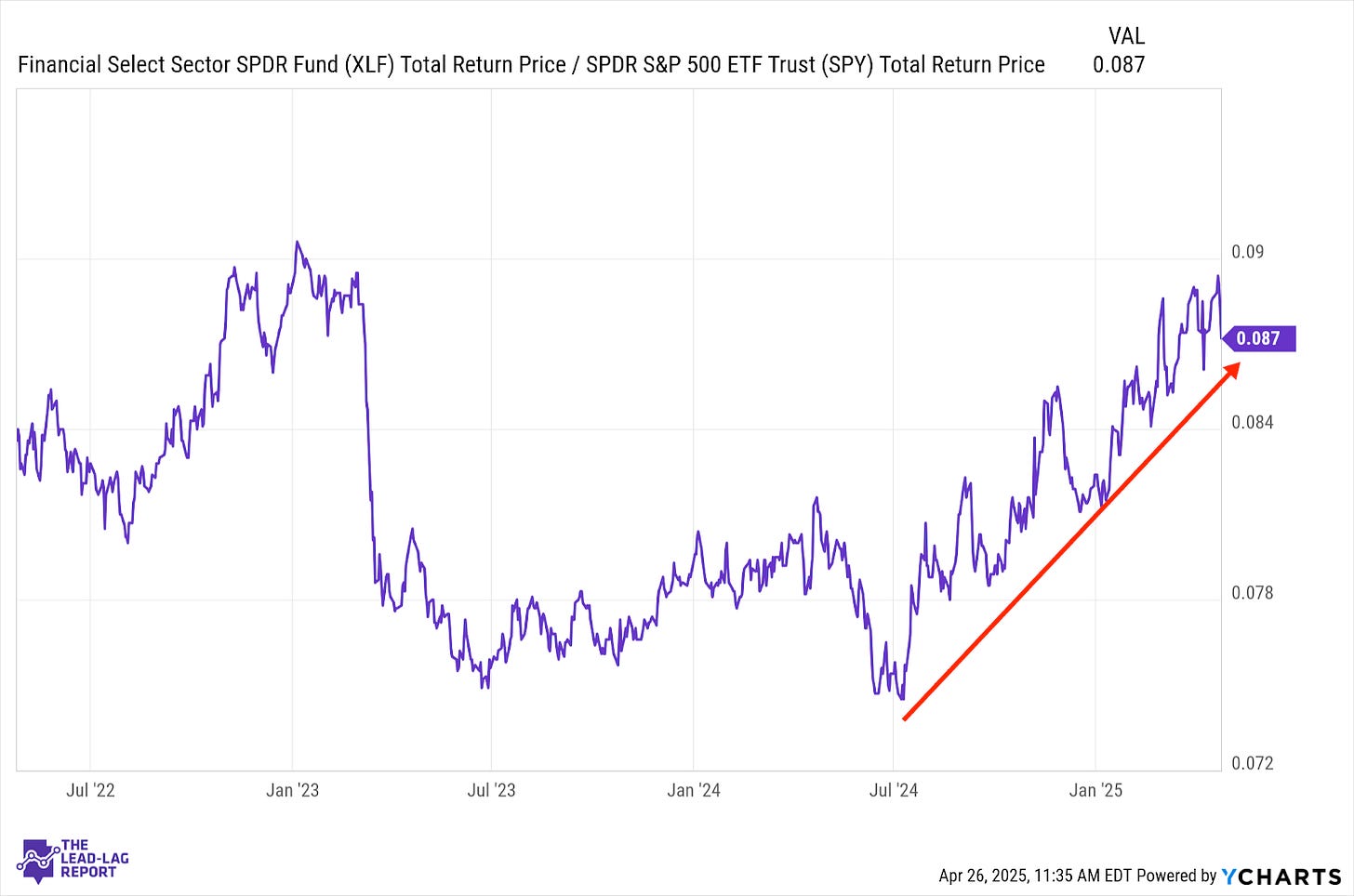

Financials (XLF) – Easing Trade Tensions Should Help

Financials are maintaining their outperformance trend, as they have throughout 2025, but the path remains choppy. Even though they lagged the market last week (most sectors did), the de-escalation in global trade should, in isolation, help lower interest rates and potentially increase loan demand. There are so many moving parts still and the data we get in the upcoming weeks should help tell us if this is just short-term.

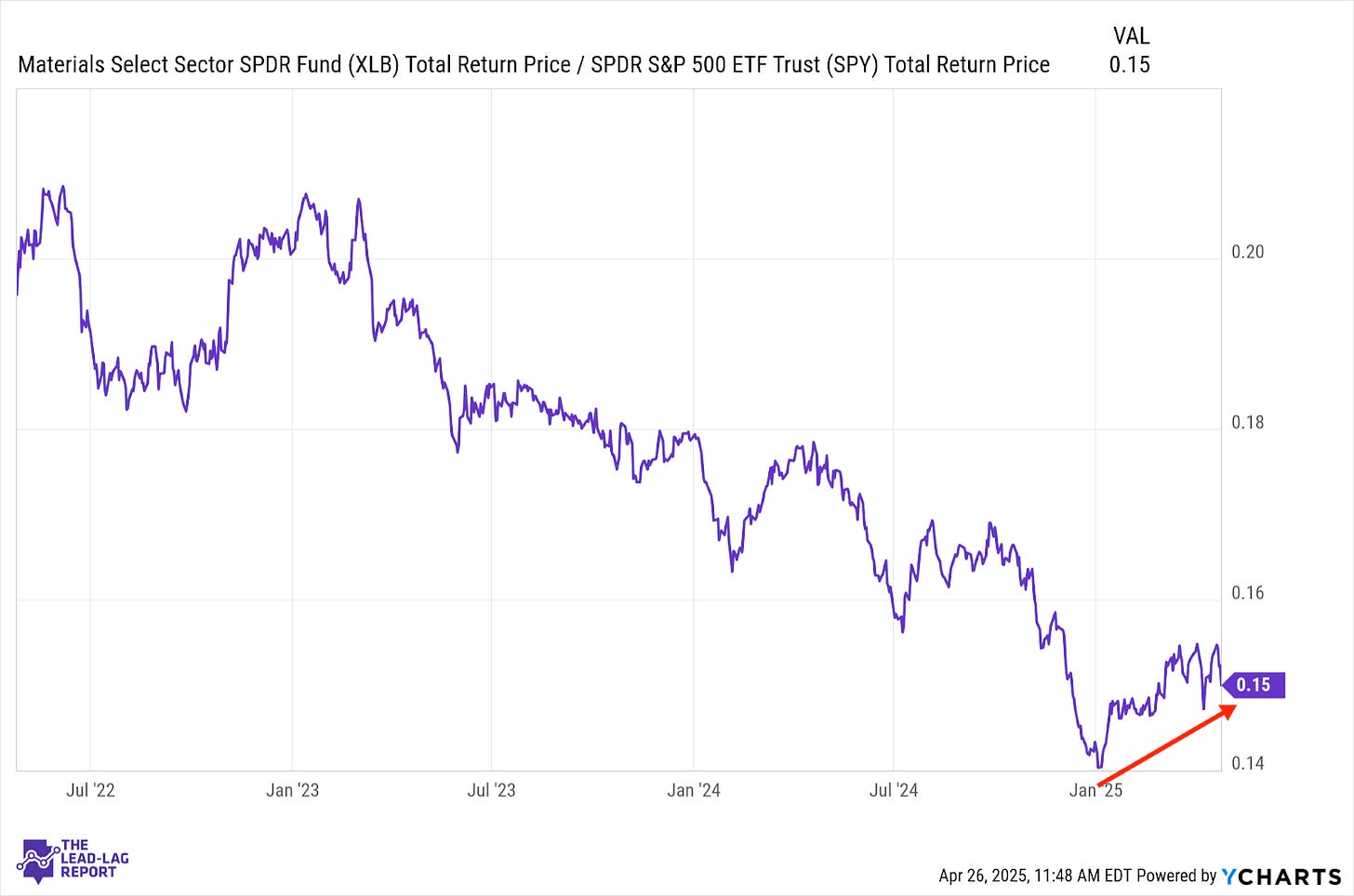

Materials (XLB) – Hitting A Ceiling

Materials are still on the upswing relative to the S&P 500, but momentum has slowed in the past month. Industrial metal and lumber prices have come down off of their highs based both on macro factors and the likelihood of lower demand as a result of trade frictions. Given the overall environment for cyclicals, we may be looking at a near-term cap on this ratio until conditions become clearer.

Utilities (XLU) – Another Market Jolt Coming