Discover the unexpected consequences of a post-pandemic housing market with renowned housing analyst Amy Nixon. As mortgage rates rise, the phenomenon of mortgage lock-in is holding homeowners back from selling, creating an intriguing paradox of constrained supply amidst cooled demand. We unravel the unconventional tactics like builders buying down mortgage rates and the rise of cash transactions, while navigating the unique challenges confronting first-time buyers. With a spotlight on regional trends in Florida and Texas, we question whether the current housing prices are sustainable across different market tiers.

Next, we dissect the interplay between federal interest rates, housing prices, and immigration. With an insightful examination of Federal Reserve Chairman Jerome Powell's stance on economic independence, we explore how immigration impacts both the construction labor force and housing demand. The intricate balance of these factors is evident in booming markets like Florida and Texas, where the decision to upgrade homes despite higher rates is a critical choice for many. Amy and I delve into the potential effects of changing immigration policies under the Trump administration and the resulting pressures on construction labor and rental demand.

If you enjoy this interview, consider joining the few who understand this as a full-access subscriber of The Lead-Lag Report through a paid subscription.

Lastly, we gaze into the future of the housing market and investment strategies for 2024. The so-called "silver tsunami" of retirees selling their homes, particularly in Florida, creates a ripple effect on local markets, influencing real estate landscapes across the nation. As we weigh the merits of renting versus owning, I share my personal investment philosophy, emphasizing assets like gold, Bitcoin, and equities that promise better wealth-building opportunities than real estate. Join us as we tackle these complex issues, offering insights that could redefine your approach to housing and investment in the coming year.

Special Announcement

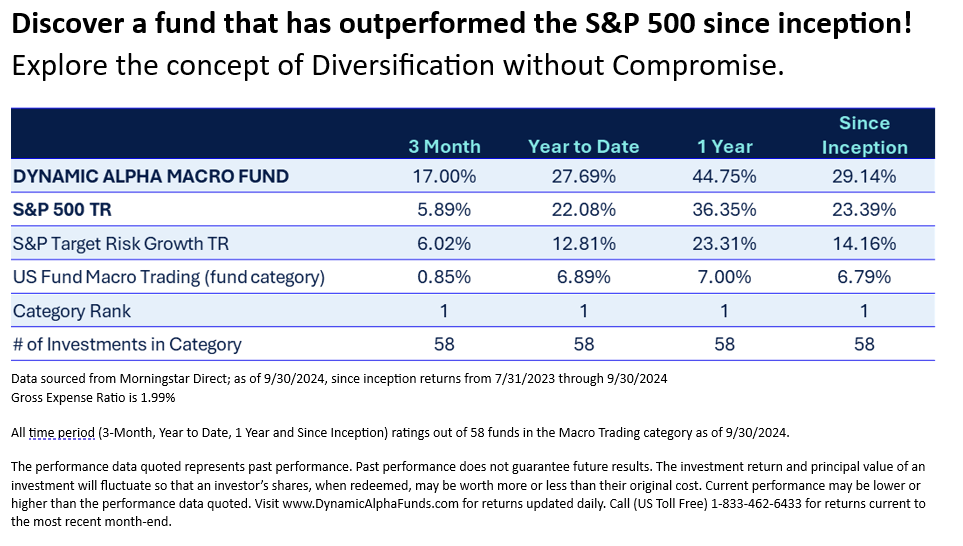

Alternatives often get a bad rap for consistently underperforming the equity markets. Non-correlation is great, but it must also perform…

Enter the Dynamic Alpha Macro Fund (DYMIX).

The Dynamic Alpha Macro Fund (DYMIX) blends two non-correlated strategies: a fundamental global macro approach and a diversified portfolio of U.S. equities. This combination aims to capture returns and minimize risk, and is designed to be an all-weather solution even in unpredictable conditions.

View our Q3 Fact Sheet HERE.

Dynamic Alpha Funds provide:

· Targeted Exposure: Gain access to over 40 liquid markets — including equities, bonds, currencies, and commodities.

· Dynamic Rebalancing: The ability to invest both long and short can help generate alpha and reduce drawdowns during market downturns.

· Diversification: By harnessing non-correlation, we strive to outperform the S&P 500 while managing risk.

Dynamic Alpha Funds is where institutional investors, portfolio managers, and sophisticated individuals come to add true diversification. Learn more about how DYMIX can help protect and grow your portfolio at DynamicAlphaFunds.com.

Disclosures:

All statements provided are for informational purposes only and do not guarantee future performance. No investment product or strategy is guaranteed to generate a profit or prevent a loss.

Request A Prospectus: Investors should carefully consider the investment objectives, risks, charges and expenses of the Dynamic Alpha Macro Fund prior to investing. This and other important information can be found in the Fund’s prospectus and summary prospectus. To obtain a prospectus, please call 1-833-462-6433 or access online at https://regdocs.blugiant.com/dynamic-alpha-macro/ . The prospectus should be read carefully prior to investing.

Important Risks: Investing in mutual funds involves risk, including loss of principal. Risks specific to the Dynamic Alpha Macro Fund are detailed in the prospectus and are linked here: https://dynamicalphafunds.com/performance-2/ . For a complete description of risks specific to the Fund, please refer to Fund’s prospectus.

Relationship Disclosure: Advisors Preferred, LLC serves as Advisor to the Dynamic Alpha Macro Fund, distributed by Ceros Financial Services, Inc., Member FINRA/SIPC. Advisors Preferred and Ceros are commonly held affiliates. Dynamic Wealth Group, LLC serves as Subadvisor to the Fund is not affiliated with the Fund’s advisor or distributor.

©2024 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

DISCLAIMER – PLEASE READ: This is sponsored advertising content for which Lead-Lag Publishing, LLC has been paid a fee. The information provided in the link is solely the creation of Dynamic Alpha Funds. Lead-Lag Publishing, LLC does not guarantee the accuracy or completeness of the information provided in the link or make any representation as to its quality. All statements and expressions provided in the link are the sole opinion of Dynamic Alpha Funds. and Lead-Lag Publishing, LLC expressly disclaims any responsibility for action taken in connection with the information provided in the link.

The content in this program is for informational purposes only. You should not construe any information or other material as investment, financial, tax, or other advice. The views expressed by the participants are solely their own. A participant may have taken or recommended any investment position discussed, but may close such position or alter its recommendation at any time without notice. Nothing contained in this program constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in any jurisdiction. Please consult your own investment or financial advisor for advice related to all investment decisions.