Join me as I interview Meb Faber, renowned investment expert, on why U.S. stocks are overvalued and the compelling case for global investing. In this insightful discussion, we explore market valuations, the importance of international diversification, and untapped opportunities in emerging and foreign markets. Meb shares data-driven insights on cheap countries, undervalued sectors, and strategies to navigate today’s investment landscape. Whether you’re curious about global markets, value investing, or diversifying your portfolio, this conversation has something for everyone. Don’t miss out—hit play and start thinking beyond U.S. stocks!

If you enjoy this interview, consider joining the few who understand this as a full-access subscriber of The Lead-Lag Report through a paid subscription.

Special Announcement

DYMIX: #1 Macro Trading Fund for 2024

Diversification Without Compromise

In today’s unpredictable financial markets, achieving true diversification is more critical than ever. The Dynamic Alpha Macro Fund (DYMIX) has been recognized as the #1 Macro Trading Fund of 2024 by Morningstar, affirming its role as an innovative solution.

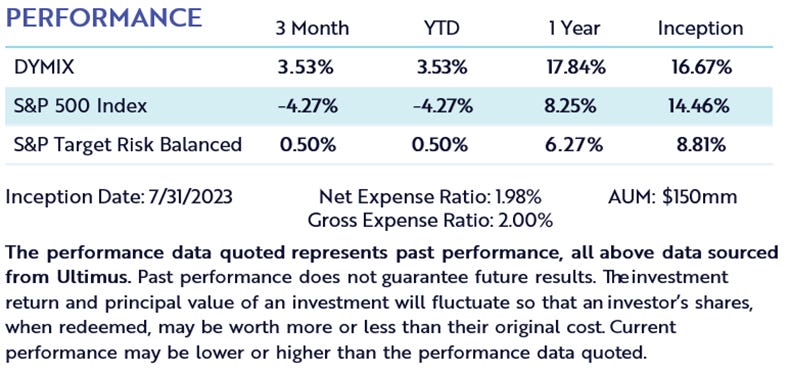

Performance as of March 31, 2025

Key Highlights:

✅ All Weather Strategy: Designed to help navigate unpredictable market conditions.

✅ Broad Market Access: Exposure to over 40 liquid markets across multiple asset classes.

✅ Dynamic Rebalancing: “Dynamic Alpha” is captured between two sets of noncorrelated strategies.

Whether you are managing your own portfolio or managing portfolios for your clients, you are seeking ways to deliver results and reduce uncertainty. DYMIX aims to offer an innovative solution built for today’s complex investment landscape.

Explore DYMIX Today

Learn how DYMIX can help protect and grow your clients' portfolios.

Disclosures:There is no guarantee the Dynamic Alpha Macro Fund will achieve its investment objective. No investment product or strategy is guaranteed to generate a profit or prevent a loss.

Important Risks: Investing in mutual funds involves risk, including loss of principal. Risks specific to the Dynamic Alpha Macro Fund are detailed in the prospectus and include limited history of operations; equity securities risk; futures and commodities risk (including currency, debt, equity, energy, metals and agricultural commodities risk); ETF risk; market risk; management risk; shorting risk; small and mid-capitalization stock risk and taxation risk. For a complete description of risks specific to the Fund, please refer to Fund’s prospectus.

Request A Prospectus: Investors should carefully consider the investment objectives, risks, charges and expenses of the Dynamic Alpha Macro Fund prior to investing. This and other important information can be found in the Fund’s prospectus and summary prospectus. To obtain a prospectus, please call 1-833-462-6433 or access online at https://regdocs.blugiant.com/dynamic-alpha-macro/ . The prospectus should be read carefully prior to investing.

Relationship Disclosure: Advisors Preferred, LLC serves as Advisor to the Dynamic Alpha Macro Fund, distributed by Ceros Financial Services, Inc., Member FINRA/SIPC. Advisors Preferred and Ceros are commonly held affiliates. Dynamic Wealth Group, LLC serves as Subadvisor to the Fund is not affiliated with the Fund’s advisor or distributor.

Read our full press release and get additional information: https://dynamicwg.com/dynamic-alpha-macro-fund-1-ranking-morningstar-category-for-2024/

© 2025 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. As of 12/31/24, the fund was ranked #1 in the Morningstar Macro Trading category out of 60 funds for the 1-year period based on total returns. Rankings are based on historical performance and are subject to change.

DISCLAIMER – PLEASE READ: This is a sponsored episode for which Lead-Lag Publishing, LLC has been paid a fee. Lead-Lag Publishing, LLC does not guarantee the accuracy or completeness of the information provided in the episode or make any representation as to its quality. All statements and expressions provided in this episode are the sole opinion of Cambria and Lead-Lag Publishing, LLC expressly disclaims any responsibility for action taken in connection with the information provided in the discussion. The content in this program is for informational purposes only. You should not construe any information or other material as investment, financial, tax, or other advice. The views expressed by the participants are solely their own. A participant may have taken or recommended any investment position discussed, but may close such position or alter its recommendation at any time without notice. Nothing contained in this program constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in any jurisdiction. Please consult your own investment or financial advisor for advice related to all investment decisions.